7 minutes

… until you do these 3 things.

This post is reprinted with permission from c. myers’ c. notes.

Sometimes we get a call for help after the fact. Among the many financial institutions that have implemented new loan origination, core or other systems, a number of them find they’re really not getting what they wanted out of the new technology. Having heard so many implementation stories, we wanted to share a few of the lessons learned and, hopefully, save you some trouble.

If we had been able to talk to those institutions earlier in the process, we would have advised them to do these three things before starting their request for proposal:

- Create a clear objectives statement

- Map the ideal process so you don’t repave the cow path

- Agree on the top decision drivers

Let’s go into each of these in more detail.

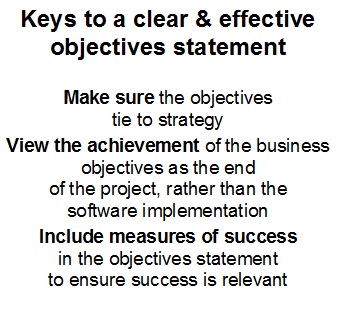

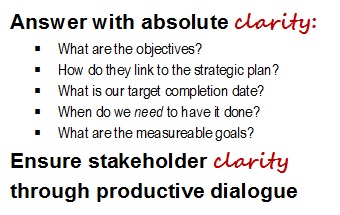

1. Create a clear objectives statement.

Doing this is not just an exercise in wordsmithing; it’s really about getting all the stakeholders to share the same vision. Problems occur when everyone thinks they’re on the same page, but they’re not. Institutions that have been successful in uniting everyone in the vision engaged in the productive dialogue necessary to agree on a clear objectives statement.

The beauty of establishing a clear and effective objectives statement is that it can and should be used diligently as a filter for the thousands of decisions to be made. It can help cut through the confusion and provide guidance throughout the entire selection and implementation process.

The beauty of establishing a clear and effective objectives statement is that it can and should be used diligently as a filter for the thousands of decisions to be made. It can help cut through the confusion and provide guidance throughout the entire selection and implementation process.

Of course, the objectives should tie to the strategy. If your strategy is to be an

ultra-efficient master of lending or to create a fast, friendly member experience, the objectives of the implementation should support it.

An effective objectives statement is not … “the software is installed and

tested, and staff is trained and using the system.”

The crux of the matter is that there is a reason for implementing new technology. It’s not simply to have the new technology or your staff using it. What is your reason? What do you want to get out of the new business processes that are supported by the new system? How will success be defined? How is it going to help the institution achieve its goals and execute its strategy?

If the reason for the new system is to book more loans, the implementation isn’t successful until more loans are being booked. The implementation is only complete when the objectives are met. This means that if the objectives aren’t being met, more work needs to be done until they are. The following objectives statement examples are of an LOS implementation for an institution wanting to be an ultra-efficient master of lending:

Not effective: We have implemented our new LOS.

Effective: We have implemented our new consumer LOS and business processes, and

our sustainable funding ratio in fourth quarter 2018 has increased by 20 percent over fourth quarter 2017.

The second objectives statement supports the strategy of being an ultra-efficient master of lending and has defined measures of success that ensure the real reasons for undertaking the new LOS are realized.

This kind of clarity does not occur in a vacuum. Stakeholders need to come together in productive conversations to reach the necessary level of understanding and agreement.

This kind of clarity does not occur in a vacuum. Stakeholders need to come together in productive conversations to reach the necessary level of understanding and agreement.

Note: Sometimes new technology is required for reasons not initially strategic, such as the need to address new compliance requirements, or for a system being phased out. But even “have to” projects often present choices in the solutions that can help support strategy. Rather than just solving the problem at hand, frame the possible solutions within the greater strategy.

2. Map the ideal process so you don’t repave the cow path.

People sometimes think mapping the ideal process before choosing the system is like putting the cart before the horse.

But consider that mapping the ideal process without the constraints of a specific system allows users and other stakeholders to imagine how they want it to work.

If the ideal process has been mapped before viewing any vendor demos, the team will have spot on, relevant questions to ask. Without having gone through the thought process mapping requires, the vendor is likely to drive the discussion and demo the coolest features, making it more difficult to think of and ask questions about what is not being shown.

Mapping at this stage will also help minimize “paving the cow path,” or simply replicating a less than ideal process using new technology. This happens frequently and it’s another common reason why the promised benefits of new systems are not fully realized.

The following are examples of learnings for mapping the ideal process:

- Focus on the member experience

- Include the doers along with managers and other stakeholders in the mapping

- If conversations start with “when a member walks in the door,” it’s time to step back and brainstorm how members will want to do business in five years

3. Agree on the top decision drivers.

In our experience, if there are eight stakeholders, there will be eight different ideas of what is most important about the technology. Beginning with agreement on the top five to 10 decision drivers leads to a more focused RFP and gets stakeholders on the same page before evaluations take place.

Several examples of decision drivers for different types of vendors and technologies include:

- Financial stability of vendor and/or years of experience

- Level of control the institution perceives it will have over vendor research and development

- Vendor’s stated service level agreements and ability to meet them

- Robust R&D track record for speed and reliability of new enhancements or products

- Cloud-based or on-premises solution

- Robust cross-sell feature

- Ability to test multiple auto-decisioning scenarios

- Mobile cross-sell capability

- Ease of integration with other systems (be specific)

The best way to nail the top decision drivers is to have discussions. Have a working agreement during these discussions that everyone will voice what they believe the technology should or should not do to uncover as many potential decision drivers as possible. Also, have a set of questions ready to help guide the conversation. As the questions are being prepared, be sure to include any features needed to accomplish the business objectives and new features available that the rest of the team may not be aware of. Once all of the potential decision drivers are on the table and all stakeholders understand them, prioritize the list and determine how many of the top contenders make the final cut.

The top decision drivers should align with and support the objectives statement. For example, if the objectives statement includes a goal for more cross-selling and none of the top decision drivers are related to cross-selling capabilities, it’s appropriate to revisit the decision drivers.

Of course, this is just the beginning—we haven’t even touched on vendor selection, setting a budget, or a myriad of other elements, but this is how to get started on the right foot. Avoid going through all the trouble and expense of implementing new technology only to find that the grass is not actually greener on the other side. Guarantee the grass is greener by gaining the clarity that comes with good up-front dialog and planning.

c. myers corporation has partnered with credit unions since 1991. The company’s philosophy is based on helping clients ask the right, and often tough, questions in order to create a solid foundation that links strategy and desired financial performance. c myers has the experience of working with over 550 credit unions, including 50 percent of those over $1 billion in assets and about 25 percent over $100 million. They help credit unions think to differentiate and drive better decisions through real-time ALM decision information, CECL consulting, financial forecasting and consulting, liquidity services, strategic planning, strategic leadership development, process improvement, and project management.