3 minutes

A CU holding company may foster economy of scale and preserve local CUs’ unique bonds with their members.

Decades ago, community banks obtained regulatory approval for the bank holding company structure. Through this arrangement, a local bank would remain legally independent and keep its own charter but become part of a larger “holding” company that owned more than one bank.

The original idea was to overcome branching prohibitions that made it difficult for banks to expand geographically. However, many discovered that the holding company was a valuable tool in two additional ways. First, it allowed the group to capture economies of scale and scope through shared holding company activities while preserving the “special sauce” of local, independent banks. Second, it helped overcome selling bank concerns about independence and community ties.

To this former bank CEO, a holding company structure seems like it could be very beneficial for the credit union industry.

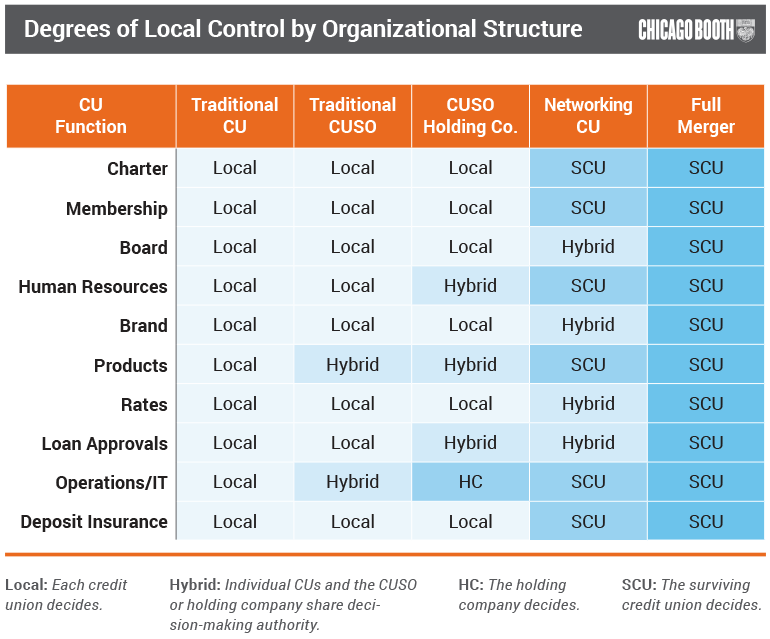

The structure of a credit union holding company could be implemented as a credit union service organization that signs agreements with each member institution to perform many functions, including overarching management. This “CUSO holding company” would be different than the traditional CUSO that provides assistance to a credit union in a particular function, such as IT or investment services. The CUSO holding company would be the umbrella organization that bonds individual owner credit unions together.

A “network credit union” could be another alternative to a traditional merger. In this arrangement (described in more detail), the “merged” (non-surviving) credit union would become part of and subsumed by the “continuing” (surviving) credit union, but the merged credit union would continue to operate and serve its former members under its original name. Members would still do business with “Merged Credit Union,” which would now also be labeled as “a division of Continuing Credit Union.”

To find out if union executives and directors feel such structures could be helpful to the industry, the University of Chicago’s Booth School of Business surveyed over 280 credit union executives and directors. Well over three-quarters (82 percent) of those surveyed feel the industry should consider a holding company structure, including 75 percent of respondents from credit unions with less than $100 million in assets.

In addition, when respondents were asked how likely they were to consider a holding company structure for their credit unions, more than a quarter (26 percent) said they were very likely to do so; 55 percent said they were likely to; and only 19 percent said such a structure was unlikely to be considered by their institutions.

Plus, executives and directors showed similar levels of interest in holding company structure, suggesting possible alignment between boards and executives on this issue.

Given the support found in the survey and the rationale provided by analogous industries (hospitals, in addition to banks), a full discussion and exploration of the concept seems warranted in multiple venues, such as credit union board meetings, local and state league meetings, and at national association meetings.

Credit unions are a valuable source of financial services with truly distinguishing bonds with their members. Given the significant and ongoing consolidation in the financial services industry, the “holding company model” may be a key tactic to preserving, perhaps even saving, the beauty of the local credit union with a strong bond with members.

Stephen Morrissette is adjunct associate professor of strategic management at the University of Chicago Booth School of Business and lead faculty at CUES’ Strategic Growth Institute™, slated for July 23-26 at the University of Chicago.