5 minutes

Promote automatic savings without taking away control.

Articles about retirement savings often disparage the continuing shift from defined benefit pension plans to defined contribution plans, mainly 401(k)s. But these laments usually leave out two characteristics of 401(k) plans:

- They can give workers far more control over their retirement savings.

- Employers can configure them to include some of the most effective attributes of defined benefit plans.

The need for better retirement savings plans is obvious. According to PricewaterhouseCoopers’ 2018 Employee Financial Wellness Survey, only 55 percent of baby boomers and 41 percent of Gen Xers are confident they’ll be able to retire when they want to. And that’s probably optimistic, when you consider how little Americans appear to be saving for retirement.

Of these survey participants, 32 percent of baby boomers have saved less than $50,000 for retirement, and another 11 percent have saved between $50,000 and $100,000. Among Gen Xers, 40 percent have saved less than $50,000 and 16 percent have saved between $50,000 and $100,000.

Even if you can’t offer employees a defined benefit pension plan today, you can still deliver some of the advantages of those plans by modifying your 401(k) plan’s design and services in the following five ways in order to help employees attain a 60 to 80 percent income replacement ratio at retirement.

1. Automatic Enrollment

Defined benefit pension plans don’t allow participants to choose how much is contributed nor how it is invested. The positive side of this is that participants can’t choose not to participate.

Create a version of this advantage by setting up automatic enrollment on your 401(k) with a default deferral rate. Your participants have the flexibility to opt out and not participate—or to contribute more and actively manage their investments. But if they take no action, they’re still benefiting from a retirement savings plan.

Vanguard collected data from more than 590,000 employees hired between 2014 and 2016 and who were still with that employer through June 30, 2017 (tinyurl.com/y7r9s7hc). Participation rates in 401(k) plans that used automatic enrollment were 93 percent—nearly double the 47 percent participation in plans with voluntary enrollment. Plus, 77 percent of the employees who were automatically enrolled had remained in the default investment fund up to three years later.

Plan participation rates are dramatically improved by automatic enrollment among young and low-income workers—two populations with traditionally low participation. According to Vanguard:

- Nine of every 10 employees younger than 25 continued to participate in 401(k) plans after being automatically enrolled, compared with only three in 10 in voluntary enrollment plans.

- Among employees who earned less than $30,000 per year, 88 percent continued to participate in 401(k) plans after being automatically enrolled, compared with 18 percent in voluntary enrollment plans.

A potential downside of automatic enrollment is that some employers set the default contribution percentage relatively low, and employees don’t increase their contributions enough to save an adequate amount for retirement.

The following two 401(k) strategies can protect participants from that effect.

2. Automatic Deferral Escalation

Defined benefit pension plans are designed for employers to contribute enough each year to ensure an adequate savings amount is set aside for employees. To promote similar results, automatic deferral escalation for 401(k) plans increases participant contribution percentages each year.

For example, an employee’s deferral rate can automatically increase 1 percent each year until it reaches a maximum percentage of their pay, typically 10 percent.

To minimize the effect of reduced take-home pay from automatic escalation, time the increases to coincide with annual pay increases, when possible.

According to the Vanguard report, after three years of participating in an automatic-enrollment 401(k), the average contribution of employees in a plan with automatic escalation was 7.1 percent, compared with 6 percent for those in plans without automatic escalation.

Vanguard’s data show that of employees who were enrolled for three years in a plan with automatic escalation, 46 percent did not opt out of the annual escalation nor change the deferral percentage. In all, over half of the participants in these automatic escalation plans did make some change to that feature—and two of every three chose to keep it.

Only 6 percent of plan participants actually decreased their contribution percentage. Automatic enrollment paired with automatic escalation of deferrals appears to be a positive motivator and a powerful retirement savings tool.

3. Stretch-Matching Contribution

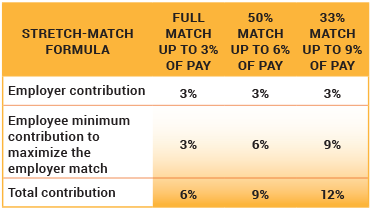

With a stretch-matching contribution, employers can encourage employees to save for their retirement without increasing overall employer matching contributions. The table above shows how stretch-matching contribution formulas incent participating employees to increase their deferral rates. In all three examples, the employer commits to contributing 3 percent of pay to employees who participate. However, the more the match is stretched, the more employees are encouraged to increase their deferrals.

With a stretch-matching contribution, employers can encourage employees to save for their retirement without increasing overall employer matching contributions. The table above shows how stretch-matching contribution formulas incent participating employees to increase their deferral rates. In all three examples, the employer commits to contributing 3 percent of pay to employees who participate. However, the more the match is stretched, the more employees are encouraged to increase their deferrals.

4. Personalized Guidance

Make professional guidance available to your 401(k) participants in ways they can easily understand and access. Do your plan participants know what their current projected replacement percentage is? If the gap between their working income and retirement income is larger than 60 to 80 percent, do they understand what it will take to close that gap?

To help your employees understand the retirement savings gap and other basic retirement savings concepts, consider giving them access to a combination of three reliable information sources:

- Personal advice from a qualified retirement savings counselor: This person should be able to tailor information to the employee’s age, retirement goals, risk tolerance and family circumstances.

- Online tools: Increase employee engagement with a provider that makes its account and educational information accessible on various devices, including desktop and mobile devices.

On-site group education events: On-site workshops can be an effective way to educate your employees all at once.

5. Target Date Funds

A pension plan’s asset portfolio is managed by the employer and its advisors to help create a diversified investment portfolio customized to the plan’s specific needs. For 401(k) participants, target date funds can fulfil that role.

Target date funds (usually a type of mutual fund) provide a professionally managed mix of stocks and bonds that are customized to the participant’s retirement age. Participants do not need to worry about which funds to select and how much money to put in each. A target date fund will evolve as a participant ages to ensure the portfolio’s diversification is appropriate.

It’s important to remember that employees don’t have to use any of these five pension-like features. In a 401(k), they can opt out of automatic features. They can choose not to take advantage of counseling or online tools.

But for employees who otherwise might not save enough for their retirement, a 401(k) with some key advantages of a defined benefits pension can provide them a comfortable and timely retirement.

Mark Couillard is the senior retirement solutions proposal manager for CUESolutions platinum provider CUNA Mutual Retirement Solutions, Madison, Wis. Reach him at mark.couillard@cunamutual.com.