4 minutes

Findings from 2019 CFO Outlook survey point to opportunities to boost performance management in a shifting business environment.

Even as institutions reported improved financial results last year, CFOs’ confidence in their institutions’ ability to manage the financial impacts of an evolving business environment decreased in 2018, according to a recent Kaufman Hall report.

The report, 2019 CFO Outlook: Performance Management Trends and Priorities for Financial Institutions, is based on a nationwide survey in late 2018 of executives from credit unions, banks, and other financial services institutions.

The report notes that although the Federal Deposit Insurance Corp. reported a 30 percent increase in net income year over year for the financial services institutions insured by the agency, those banks and savings institutions also face increased exposure to interest-rate and credit risk, as well as emerging competition from “neobanks” and other nontraditional competitors.

The combination of disruptive economic forces and increased competition has had a significant impact on senior executives’ confidence in their institutions’ ability to make course corrections in response to changing market conditions:

- Just 22 percent of senior executives are “very confident” in their institutions’ ability to manage the financial impact of changing business circumstances, down from 35 percent in 2017. Sixty-five percent are “somewhat confident.”

- Meanwhile, 95 percent of senior finance executives believe their institutions should be doing more to leverage financial and operational data to inform strategic decision making as business conditions change.

- Additionally, 94 percent of senior finance executives are experiencing increased pressure to provide greater insight into how financial results impact business strategy.

These results and others point to critical opportunities for financial institutions to boost performance management in a transformative business environment. Here are three strategies to consider.

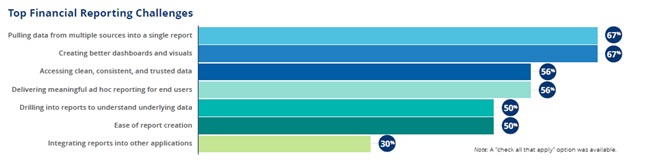

Strategy No. 1: Enhance access to and use of high-quality data and analytics to improve strategic decision-making. This strategy requires tackling the top financial reporting challenges experienced by finance executives, namely “integrating data from multiple sources into a single report” and “creating better visualizations” (two-thirds of executives cite each), and “accessing data that can be trusted,” which half of executives indicate as a challenge.

Today’s senior finance professionals have access to more data than ever, but they must be able to leverage that data to understand business trends and provide actionable insight. Reports based on analytics should do more than simply provide results. They should help executives answer three critical questions:

- Why do these results matter?

- What can we learn from the numbers?

- How can we make better decisions based on this information?

Taken together, the answers to these questions address the question, “So what?” They move leadership teams beyond descriptive analyses to diagnostic analyses that support decisions to sustain and advance competitive performance.

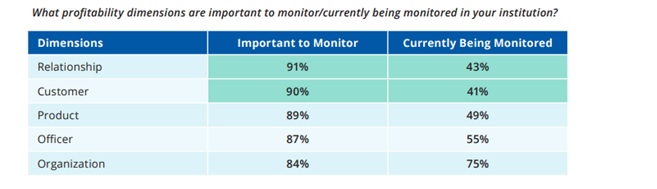

Strategy No. 2: Seek ways to better understand and measure profitability and its drivers, particularly relationship profitability. Survey results show the two profitability dimensions CFOs deem most important are the relationship (i.e., the full breadth of customers influenced by a single customer) and customer. Yet just 43 percent of senior finance executives say their institutions monitor relationship profitability, while only 41 percent monitor customer profitability. Among those that do measure relationship profitability, 41 percent have only basic information to evaluate the impact of new accounts on a relationship.

Does your institution have the means to measure the profitability of each relationship and customer? If so, how difficult is this to do, and what data, metrics and calculations are used? Good data are the foundation of any actionable profitability framework or system. Desired attributes include a single repository for both sourced and derived data, a robust calculation and modeling engine, and analytic capabilities that offer finance leaders the ability to leverage profitability information to understand and improve financial performance.

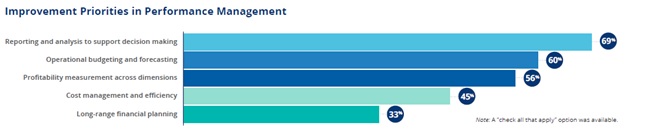

Strategy No. 3: Advance reporting and analysis to support decision-making. Given the many pressures faced by financial institutions, CFOs indicate no shortage of improvement opportunities in performance management. Sixty-nine percent of CFOs cite “reporting and analysis to support decision-making” as a top priority, giving this function the No. 1 ranking.

Additionally, more than half (56 percent) of CFOs cite “profitability measurement across dimensions” as a priority. This function enables the identification of the most profitable growth opportunities, which extend the CFO role beyond a singular focus on directing financial operations and the related control/monitoring functions. CFOs recognize their expanded roles in providing insights to support high-quality decision making across the institution.

A Call to Action for Finance Leaders

In a changing business environment, senior finance executives must pivot from a siloed, micro view of unconnected processes and tools to a macro view that uses integrated information and analytics to inform strategy and performance. They also should encourage investment in tools that enhance decision-making and support profitability measurement across multiple dimensions. Doing so will position their institutions for improved performance—now and into the future.

Ken Levey is VP/financial institutions for Kaufman Hall, Chicago. For more information on survey results and their implications for improved performance of financial institutions, download the report.