5 minutes

The COVID-19 crisis is testing credit union leaders—be ready to retain and recruit those who are proving their worth.

The unique challenges of 2020 have changed the trajectory of some credit union executives’ careers. It may take several more months, or even a couple of years, to see how the pandemic will reshape C-suites. By re-assessing your supplemental executive compensation program now, however, you can improve your odds of emerging from this crisis with an even stronger executive team.

In executive compensation terminology, a SERP refers to a supplemental executive retirement/retention/recruitment plan. Note those three Rs (and there’s a related fourth R—Results—that I’ll explain later). SERPs usually provide some deferred compensation, through a combination of 457(f), split-dollar life insurance or 457(b) programs.

As the pandemic’s effects abate, you may experience one or more of the following scenarios in which your credit union can benefit from creating or adjusting SERPs. I’ve included which of the three Rs are mostly likely to be involved in each scenario:

1. Executives decide to retire early (Recruitment/Retention/Retirement)

If your credit union appeared to have a relatively clear line of executive succession in place going into 2020, that may change soon if it hasn’t already. The coronavirus that caused this crisis—and the resulting stress—has changed circumstances for many executives and their families. If this causes even one early retirement in your leadership team, it may start a domino effect of promotions and/or outside hires.

To recruit the best executive talent from the outside, offering a SERP up front can help you compete with commercial institutions that can offer stock options and other perks not available to credit unions. One way to do this is to include in an employment contract containing an agreement to consider implementing a SERP after 6-18 months of employment.

For internal hires who are moving up the management chain, you can help establish continuity by offering or enhancing supplemental retirement income, such as with a split-dollar life insurance and/or a 457(b) plan. To improve retention, also consider a 457(f) plan, which allows you to offer lump-sum payouts at regular intervals, so executives don’t have to wait until retirement for deferred benefits.

2. Executives who were planning to retire will stay on longer (Retirement)

Executives who were planning to retire sometime in 2020 or soon thereafter may decide this is not the time to leave. There are two typical reasons this might happen:

- Their boards ask them to stay on to help get the credit union back on even footing as the economy and communities recover.

- Retirement investments may underperform, and/or the executives’ household income was seriously affected by the pandemic. These executives’ retirement portfolios may need to be adjusted, and these people may need to work longer to achieve the target retirement income level.

SERP instruments are often calculated for a specific retirement date, so executives who choose to put off retirement should review their situation with SERP providers. For example, if a lump sum payout was timed for post-retirement for the tax advantages, that payout may need to be delayed, if possible.

3. New leaders have emerged (Retention)

Adversity can hone an executive’s abilities and reveal hidden strengths. You may want to reward these rising stars with promotions, SERPs and other incentives for them to stay long-term. But don’t wait too long—these people will be in demand.

4. Processes and responsibilities have changed (Retention/Retirement)

Getting “back to normal” after COVID-19 may not be realistic. Changes in how and where employees work and in how your members do business with you may have changed your operations permanently. Accordingly, your organizational structure will probably shift. Reviewing all executive compensation, including your policies regarding SERPs, should be part of the board’s strategic planning.

Results: The 4th R of Supplemental Exec Benefits

In the 2019 CUES Executive Compensation Survey results, 37.1% of responding credit unions offered CEOs a 457(f) plan and 43.9% offered CEOs a 457(b) plan. Split-dollar life insurance programs have almost reached that level now, with 35% of the surveyed credit unions offering one to their CEO—a 36% increase over the 2017 survey.

The steady increase of these supplemental benefits over the years indicates that credit unions are seeing positive results from competitive compensation packages. And these products aren’t just for CEOs anymore.

For example, according to the 2019 survey, 20% of chief operating officers received split-dollar plans, an increase of almost four times since 2017. The increase over that period for chief lending officers was over 104%, and for chief financial officers it was 47%.

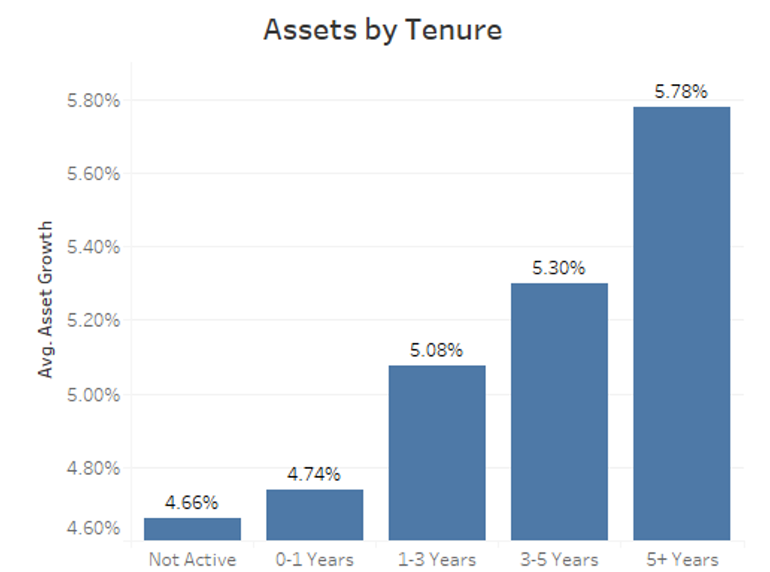

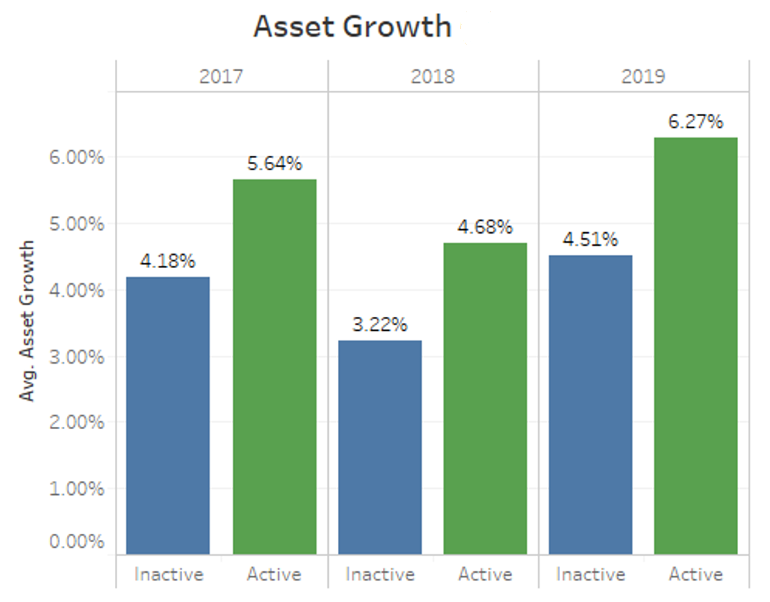

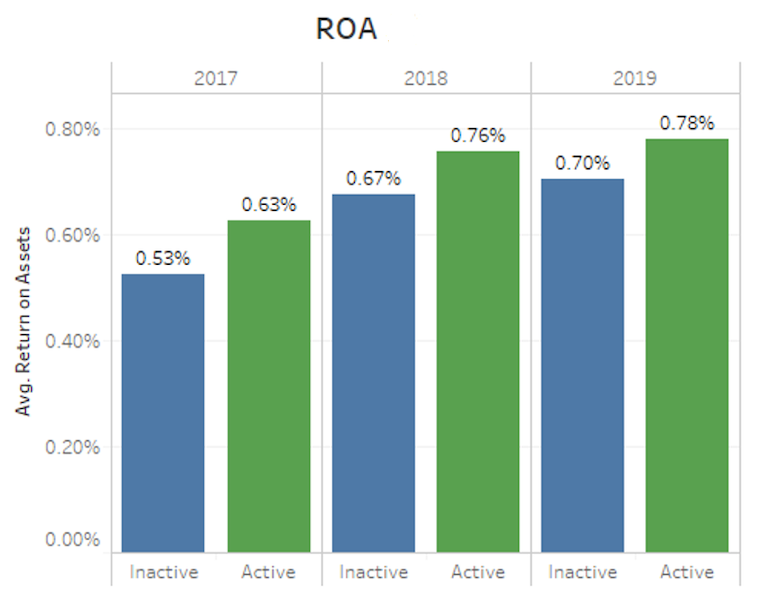

The graphs below, compiled from CUNA Mutual Group internal data and NCUA 5300 Call Report statistics, show that SERPs are part of the strategy for many high-performing credit unions. To be clear: We’re not saying these numbers prove that SERPs are the direct cause of good performance. But it’s likely that SERPs contribute to good executive performance and to recruiting/retaining good talent, which in turn influences credit union results.

Graph 1: Average Asset Growth by Executive Benefits Program Tenure

Graph 2: Average Asset Growth for Credit Unions With Active Supplemental Exec Benefit Programs vs. Those That Don’t

Graph 3: ROA for Credit Unions With Active Supplemental Exec Benefit Programs vs. Those That Don’t

Give Yourself Enough Time to Get SERPs in Place

You may have executive compensation issues on the back burner during these uncertain times. But don’t wait until you lose good talent to competitors, or to early retirement, to address supplemental executive benefits.

These programs often take months, even up to a year or more, to put into place. Why? You may need varying amounts of time to compare bids from providers, assess the individual needs of your executives or recruits, create a plan and complete legal documentation. And that’s before any products or investments are purchased.

Also keep in mind that most credit union boards don’t have direct experience with SERPs and the products involved. There’s a learning curve, and that takes time.

Andy Roquet is a senior executive benefits specialist for CUESolutions provider CUNA Mutual Group, Madison, Wisconsin. Reach him at AndyRoquet@cunamutual.com.