8 minutes

Steady executive salary and bonus awards set in 2019 form foundation for recognizing leadership through the pandemic.

In the year that seems so long ago now—2019—pay raises and bonuses for credit union CEOs and other executives averaged out to steady increases, reflecting some economic softening by year-end, according to the 2020 CUES Executive Compensation Survey.

And then COVID-19 changed everything.

Still, the survey “offers good benchmark data to help people find their way through these decisions in 2020 and moving into 2021,” says Michael Becher, CPA, vice president of Industry Insights, Dublin, Ohio, which administers the CUES survey.

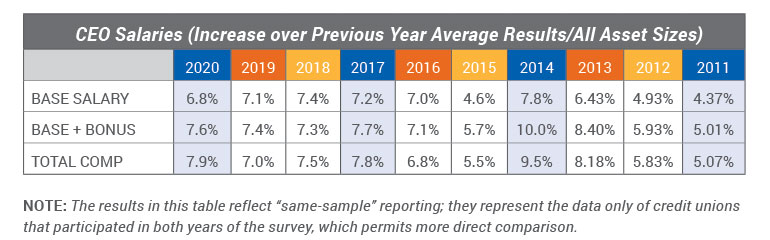

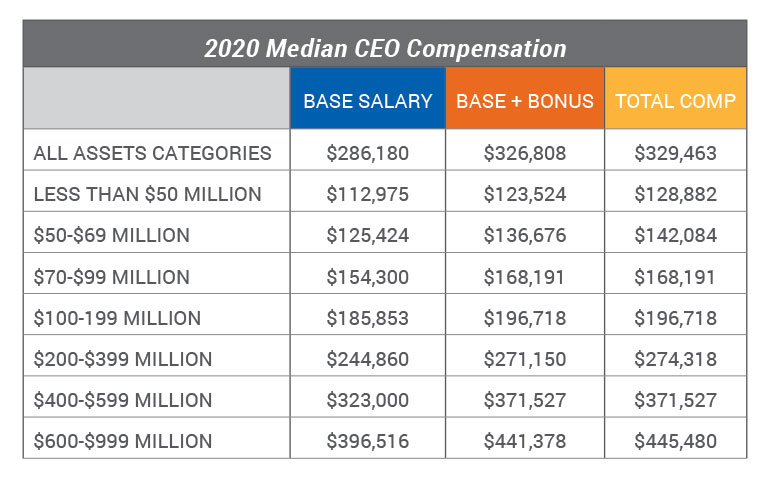

The median base salary for CEOs in this year’s same-sample survey results (limited to credit unions participating in both years to more clearly indicate trends) is $388,989, up 6.4% over 2019, while the median $442,217 in base plus bonus pay is up 7.1% and total compensation of $458,515 reflects a 7.4% increase.

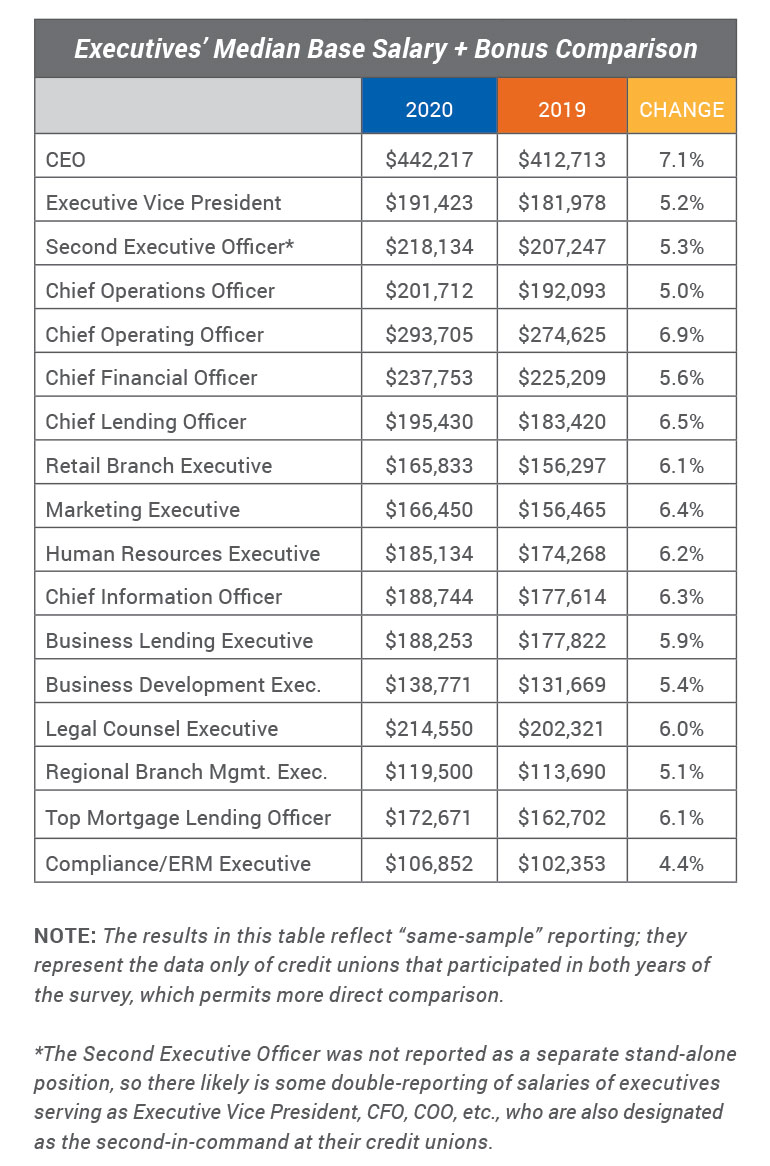

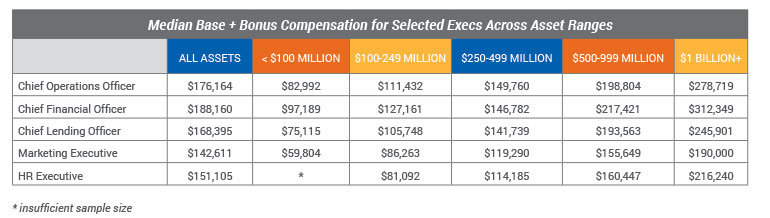

Participating credit unions reported pay increases and bonuses raising compensation in the median range of 5 to 7% for a majority of executive positions included in the survey, though overall, those raises were slightly down from the previous year, Becher notes. That pattern likely reflects economic indicators such as a year-end 2019 slowdown in the GDP, declining interest rates and an inverted yield curve, which is typically an early indicator of recession.

The increases in executive compensation follow a year of steady growth across the U.S. credit union industry, with the NCUA reporting a 6.2% increase in total loans, a 7.8% boost in total assets and an average 11.37% net worth ratio at year-end 2019.

The chief operating officer position topped all titles except for CEO, for total compensation at a median $306,205, a 7% increase over 2019. Examples across the range of other positions were chief financial officer $240,560 (5.7% increase), chief information officer $189,064 (6.2%), retail branch executive $171,342 (6.1%), and compliance/enterprise risk management executive $107,571 (5.1%).

New Executive Positions

The 2020 survey introduces four new executive positions, reflecting the evolution of operations and offerings across the financial services industry:

- Chief member solutions officer, described as “responsible for growing credit union membership and providing effective member sales and service through the credit union’s branch offices, call centers and electronic channels. Develops, implements and assesses member services strategy.” The median base salary for this new position across asset sizes was $197,191; median base plus bonus and total compensation were the same at $262,801.

- Delivery channel executive, who is “responsible for the credit union’s call center, electronic banking and retail delivery channels. Develops and implements the strategic planning, development and growth of traditional and non-traditional channels. Typically reports to the chief member solutions officer or chief executive officer.” Median base salary was $125,498; base plus bonus $146,880; and total compensation $147,108.

- E-commerce executive, “directs the credit union’s e-commerce planning and functions. Establishes the business model for e-commerce activities that meet member needs. Identifies digital and e-commerce partners aligned with business and brand strategies.” Median base salary was $156,268; median base plus bonus and total compensation were the same at $165,106.

- Investment services executive, “responsible for the development, implementation and monitoring of investment services strategies. Provides leadership and supervision to investment professionals. Works with departments to create new and cultivate existing, member relationships. Coordinates broker dealer relationship and keeps abreast of competitor, industry and regulatory trends.” Median base salary was $151,152; median base plus bonus and total compensation were the same at $254,145.

The heavy reliance on bonus compensation for the investment services executive position is an outlier among credit unions, but consistent with compensation practices in the wider investment services sector, Becher says.

The new positions are definitely more prevalent among credit unions in the $1 billion-plus asset range, which typically have more diverse operations and the resources to allot to executive roles charged with leading these areas, he notes.

In recent years, the asset size of credit unions participating in the survey has migrated upward. From the 2019 to 2020 survey, for example, the number of participating credit unions with less than $100 million in assets declined from 58 to 46, while the number of $1 billion-plus credit unions increased from 84 to 103. Forty-six percent of participants in this year’s survey are with credit unions with more than $500 million in assets.

Compensation Planning for a Post-Pandemic Era

Despite 2020’s social and economic upheavals, CUES survey data continues to hold great value for boards seeking to develop a competitive CEO compensation package in line with the market, says Scott Dettmann, principal consultant with Carlson Dettmann Consulting, Madison, Wisconsin.

It can be challenging for credit union board members to get comfortable with competitive executive salary and bonus practices, compared with their own personal experience on what constitutes “a fair day’s wage,” he notes.

In Dettmann’s compensation consulting practice, the vast majority of clients followed through on plans to award staff raises this year despite the economic downturn, though a number of organizations reduced the increases by a half to full percent over their initial plans.

That observation is in line with the WorldatWork Salary Budget Survey for 2020-2021, which reports that employers awarded a median 3% raise this year across their employee base, from nonexempt hourly workers to officers and executives, and are planning to provide the same levels of pay increases for 2021.

Dettmann suggests that credit union directors may need to do a bit more digging than usual this year to assess their CEO’s leadership through the pandemic. Over at least the past decade, CUES survey respondents have listed four top factors for determining CEO bonuses—earnings, board evaluation, loan growth and membership growth—which tend to skew toward answering the question, “Did we make money?”

“Many board members have a preference for an incentive formula based on four or five quantitative measures. They’re comfortable with that approach because the business itself creates the numbers on which they can base their compensation decision,” he notes.

But if their credit union’s financial performance suffers a COVID-related hit this year, directors may need to consider more qualitative measures of how the CEO led the organization through the crisis, he says. The board could appoint a committee of directors to conduct interviews and study employee and volunteer surveys to answer such questions as:

- In what ways and how well did the CEO work to motivate and inspire the organization?

- Has the CEO communicated effectively in leading the credit union’s pandemic response and in supporting employee and member needs?

- Has the CEO made consistent efforts to keep board members fully informed regarding the condition of the credit union and the underlying factors influencing its condition?

“It comes down to the board taking stock of where their credit union stands, understanding what they’re in business to do and how well the CEO has done in managing the institution in these very challenging circumstances,” Dettmann adds. “While we’ll better understand the economics of the pandemic as we move into 2021, there’s no question that the crisis has significantly affected credit unions and their members.”

The impact of the pandemic on economic conditions will likely continue to be in flux as credit unions make compensation decisions this fall and winter, Becher suggests. That impact will vary by region and fields of membership on the rates of consumer, mortgage and business loan delinquencies and asset-liability management, to name just two areas of challenge.

Just months ago, a strong U.S. economy was driving record levels of employment. With every compensation study his company conducted across industries, finding and retaining talent was the chief challenge, Becher says.

“And now millions of people are unemployed, and there are many more people looking for work than there are jobs available,” he notes. “But that could change just as quickly. I think we’re all just sort of watching and waiting to see what happens next and how we recover from this.”

Credit union boards will be studying standard financial indicators to assess how their organizations have fared through these unparalleled times in making executive compensation decisions for 2021. There is potential for smaller bonus and incentive compensation awards in the coming year, based on those economic impacts.

The industry—and the world—may be in upheaval, but reliance on solid data to align compensation with talent recruitment and retention strategies remains unchanged, Becher says.

“Is your credit union looking to be a market leader and pay for the best talent available? In that case, you’ll look at base and bonus compensation and decide to pay a little bit more to get the best talent,” he notes. “Credit unions with a different philosophy will aim to pay right at the median benchmark, and some a bit lower, maybe given their geographic market or other reasons.”

The CUES Executive Compensation Survey offers a wide range of options for subscribers to analyze salary, bonus and benefit trends with peer credit unions in custom reports by asset size, region, field of membership, number of members, number of employees and other factors. cues icon

CEO Bonuses and Other Exec Benefits

According to the 2020 CUES Executive Compensation Survey, nine in 10 CEOs were eligible for bonuses, up from 88.3% reported in 2019. Other findings from this year’s survey include:

- The average CEO bonus was 17.7% of base pay, with a range from 7.7% at credit unions with less than $50 million in assets to 27.7% among $1 billion-plus institutions.

- Almost all CEOs (95.7%) were enrolled in 401(k) retirement plans; in addition, 45.3% also received retirement benefits in the form of 457(b) plans, and 38.5% were enrolled in 457(f) plans. A 457(b) plan permits executives to set aside more of their income to supplement retirement savings, while a 457(f) plan is an employer-funded deferred compensation program that a credit union might structure to reward and retain executives.

- Topping the benefits list for CEOs were supplemental life insurance (39.7%), split-dollar life insurance (at 35.3%) and executive long-term disability coverage (24.1%).

- Almost half (47.2%) of CEOs at credit unions participating in the survey have employment contracts, with the most common term of three years (36.6%).

- Among common contract components were severance pay (84.7%), change-in control provisions (54.1%), non-compete covenants (36.4%), provisions to continue specified benefits post-termination (35.9%) and a covenant not to solicit employees to move to the CEO’s next organization (34.1%).

Karen Bankston is a long-time contributor to Credit Union Management and writes about credit unions, membership growth, marketing, operations and technology. She is the proprietor of Precision Prose, Eugene, Oregon.