9 minutes

What steps can credit unions take to promote work-life balance and career advancement for women facing competing demands?

As the COVID-19 pandemic continues into its third year, many women continue to face outsized challenges in finding and maintaining stability, success and advancement at work because they are caught in a double bind between job demands and family obligations.

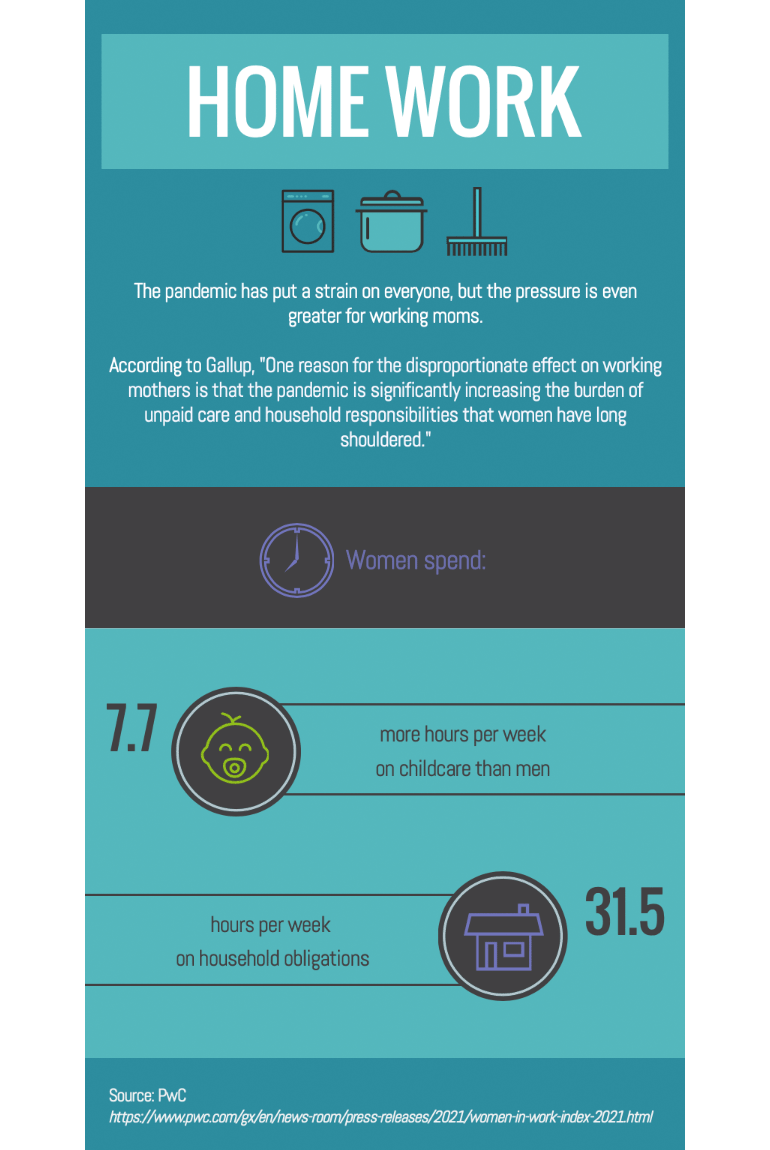

Women in the workplace often feel the competing demands of work and home more than their male counterparts. The pandemic only intensified that tendency when many employees were asked to work from home full time indefinitely, which blurred the boundaries between work and home life more than ever before.

Studies show that most household responsibilities fall to women, even if they work full time, including caring for children, elderly parents or other family members. This is the double bind for working women: Decision-making around how to prioritize home obligations against work obligations can be fraught and make women feel they can’t win in either situation, no matter what they decide to do.

Required and reinforced by cultural and gender norms, the uneven distribution of household responsibilities is a primary driver of women opting for lower-level positions or leaving the workplace altogether. This trend predated COVID-19 but went into overdrive at the onset of the pandemic, helping to fuel a Great Resignation that’s still happening today.

Stress, Burnout and Leaving the Workforce

Duties that may fall to women at home often include an “invisible” workload, says Laurie Maddalena, MBA, CSP, CPCC, CEO of CUES Supplier member Envision Excellence, Laytonsville, Maryland, and a mother of three children. “I do things around the house that aren’t ever seen, like tracking schedules and signups for camps and activities. I’m the one communicating with tutors, delivering cards for teachers and buying birthday party gifts,” she notes.

These hidden family obligations can add to the pressure and stress felt by women in the workforce. “As a mom, I feel guilty if I don’t take my kids to their doctor appointments,” Maddalena says. “I split duties with my husband, but there are internal pressures based on conditioning and societal expectations that women grapple with.”

A recent Deloitte survey, “Women @ Work 2022: A Global Outlook,” found that 53% of women say their stress levels are higher than they were a year ago, with almost half feeling burned out. The survey also reports that women are more likely to be looking for a new role than they were a year ago, citing burnout as the main reason.

As the pandemic continues to take a toll on employees, burnout is escalating much faster among women than men, wrote McKinsey & Company and LeanIn.Org in their “Women in the Workplace 2021” report, which also found that one in three women says they have considered downshifting their careers or leaving the workforce.

Other work-life balance stressors that can create burnout among women and affect their mental health and well-being are an “always on” work culture, making employees feel like their career progression will be affected if they aren’t available 24/7, and a lack of flexibility around when and where employees are able to work

“Data shows that far more women than men left the workplace during the pandemic, and many are not returning,” says Lynn Heckler, EVP/chief talent officer at CUESolutions provider PSCU, St. Petersburg, Florida. Heckler is responsible for advancing PSCU’s strategic human resources initiatives. “This should be alarming to organizations in the face of an unprecedentedly difficult labor market where leadership bench strength can become a competitive differentiator,” she says.

Effects of Gender Bias

As a whole, women in the credit union industry say that they struggle to “have it all,” according to a 2021 Pink Paper by the Global Women’s Leadership Network on advancing women’s leadership in credit unions. The report, “We for She: Advancing Women’s Leadership in Credit Unions,” highlights many obstacles that women in credit unions face in advancing professionally and contributing to the growth of their organizations.

“Social and cultural norms and bias hold women back from advocating for leadership positions and resources, including promotions and salary raises,” the GWLN report says. “Globally, women occupy far fewer leadership positions than men.”

The McKinsey/LeanIn.org report likewise found that women are significantly underrepresented in senior leadership roles, with only 24% of C-suite roles currently being held by women.

The gender bias affecting female leaders can also be complicated by other intersectional biases, such as those involving race, ethnicity and sexual orientation. For example, within the credit union community, “women of color continue to experience frequent microaggressions and unconscious bias,” according to the GWLN report.

This finding is echoed in the Deloitte report, which says that women in ethnic minority groups and LGBT+ women are more likely to have experienced such microaggressions as being interrupted or talked over, and that LGBT+ women are more than 10% more likely to say they have been patronized or undermined by managers because of their gender.

Promoting Work-Life Balance

When women feel they must be everything to everyone, both in their personal lives and at work, the strain on their mental health can result in exhaustion, emotional depletion and lack of self-care.

Maddalena believes that, beyond traditional company-provided benefits like health care plans, credit unions need to equip employees with tools to manage their health, such as employee assistance programs to break down stigma around mental health or virtual sessions on well-being and stress reduction that integrate a “whole-being approach.” She recommends workplace support groups as places employees can connect and meet informally to get encouragement and assistance from colleagues.

GWLN members strongly recommended that credit unions take these two steps to support women’s work/life balance, according to “We for She: Advancing Women’s Leadership in Credit Unions”:

- Offer sessions and services that reinforce the importance of well-being and stress reduction.

- Examine work policies and investing in flexible and remote work arrangements so that women “do not have to sacrifice their commitments to being actively engaged family members while also being top-notch performers in the workplace.”

In response to staff stress during the pandemic, one credit union leader also set up “listening committees” for people to share their experiences, which “enabled employees to feel heard and valued and created a better relationship between management and staff,” according to the GWLN report .

“Creating a psychologically safe space at work is critical,” says Heckler. Credit unions should normalize using mental health services and “ensure that team members aren’t ridiculed or discriminated against when they need a mental health break,” she says.

Additionally, leaders from the top down—men and women, parents or otherwise—need to make sure they are modeling healthy work-life boundaries. “Sometimes we assume this is obvious, but at a cultural level, do your leaders know what it means to set boundaries?” Maddalena asked.

“I was talking with a credit union professional who says there was an expectation that you’re constantly connected, even on vacations and weekends, but people aren’t aligning with this,” she says. “As leaders, we need to demonstrate our focus on employee well-being, which includes allowing employees to disconnect to rest and rejuvenate. In most cases, people don’t need to be on call on their vacations and on weekends. People need to be able to go on vacation and not think about work.”

At another credit union that has transitioned to a hybrid work environment, Maddalena shares, “the CEO started modeling positive behavior by taking her dog for a walk for 45 minutes each day to show it’s okay to take a break and be away from the computer.”

Ways to Attract and Retain Women

Credit unions have many options to help women get back onto their career track when they return to the workforce after an extended break for childcare or other family obligations—or to help keep them from leaving in the first place.

Women with employment gaps on their resume are often at a competitive disadvantage when returning to the workforce, so first and foremost, “HR teams and hiring managers must stop relying on number of years of experience when determining if an applicant is qualified for a job,” says Heckler. “Job requirements should take a candidate’s ability, potential and competencies into consideration—not just the number of years in a role.”

Both Maddalena and Heckler agree that to support women in the workplace more effectively, credit unions also must move away from the traditional emphasis on tracking time and activity, and instead focus on employee output and results.

“Where can we get away from the command-and-control, micromanagement focus and shift to giving employees more autonomy?” asks Maddalena. “We need to be clear about expectations and measure results.”

These days, whether searching for a new job or making decisions about staying at an existing one, “women are seeking increased flexibility, including hybrid or remote working options, additional paid leave time, etc.,” says Heckler. “Employing radical flexibility is the new standard for progressive companies.”

Flexibility and family-friendly policies are also some of the best ways to attract and support working single moms, who may face challenges caused by a potential lack of a built-in support network.

Credit unions typically are required to have some people available in person at their physical workplace, so they can’t offer every position as virtual. Remote or hybrid work options will not be the answer for everyone, but there’s more than one way to offer flexibility to employees.

“There are ways we can prioritize employee well-being even if they have to be in the office,” Maddalena says. “Allowing employees autonomy over their work life and some flexibility options, you’re still going to get results, and they will bring their best selves to work,” she says.

Ultimately, moving the needle on advancing women in the workplace will depend on bold action, including a change in thinking about workplace culture, Heckler says. “We need to intentionally create a culture of inclusivity and psychological safety at the top, along with offering abundant professional development opportunities for women, in order to truly realize the potential of women leaders.” cues icon

Amy Freed Stalzer, CAE, is a writer and communications consultant based in the Washington D.C. area.

Join us for CUES RealTalk!

Join us for this quarterly discussion and you will hear from a panel of accomplished female leaders, experts, and professionals in a candid discussion about the challenges women face in the workplace their male counterparts do not.