6 minutes

If credit unions want to compete with digital banks, they need to provide an easy and elegant experience.

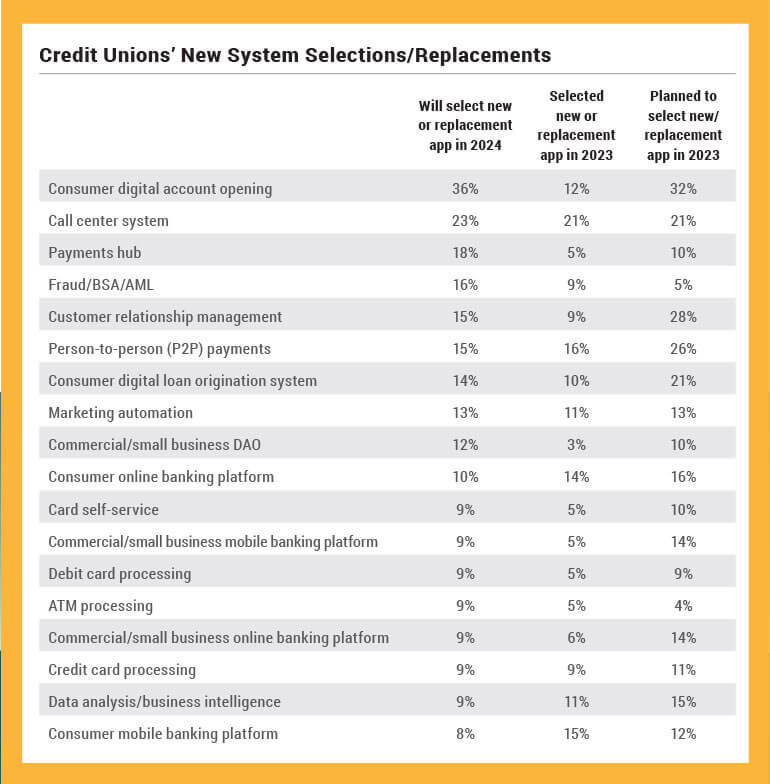

At the top of credit unions’ new system replacement list for the fifth straight year? Digital account origination systems, according to Cornerstone Advisors’ 2024 “What’s Going On In Banking” report.

Why? Credit unions treat the consumer digital account-opening process as an extension of the branch account-opening process, failing to match the experience of digital-first bank accounts like Chime and Varo.

Automated branch-based account-opening platforms have been around for ages. These systems are called “platforms” because the earliest new account teams would sit on raised platforms in the branches in order to see anyone who entered the lobby while using software to open accounts. In today’s world, credit unions’ ability to rely on branch traffic to generate account openings is waning.

In our benchmarking studies, Cornerstone has found that new deposit accounts per branch have been declining for years, from an average of 44 per month pre-pandemic to fewer than 20 per month today. Adding to this decline in branch account openings, these same benchmarking services show that the open-to-close ratio for credit unions hovers around 1.2:1—that is, for every 12 new accounts opened, 10 are closed. This data suggests that many deposit types are “hot deposits” that are easily lost to higher rates offered at other institutions.

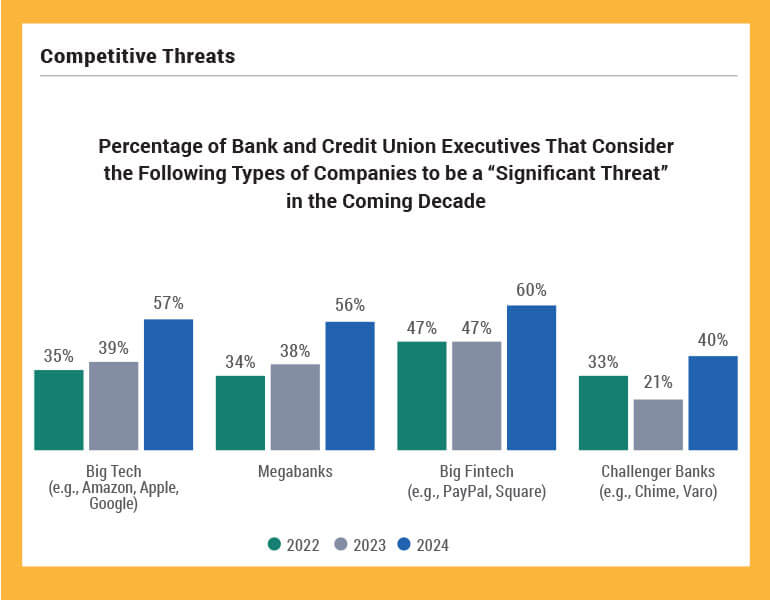

Where are these accounts going? To digital banks. During the pandemic, digital banks grew by a whopping 67%. Now, more than 14 million Americans view a digital bank as their primary financial institution. According to the 2023 “What’s Going On In Banking” report from Cornerstone Advisors, over the past five years, the percentage of new deposit accounts opened with digital banks grew to more than 20%. This growth has spurred credit union executives to see the fintechs and challenger banks as a growing threat.

That’ll Cost You

If 2023 was “The Year of the Deposit,” then 2024 is “The Year of the Cost of Funds.”

Credit union executives cited the cost of funds and new member growth as their number one and two priorities for 2024, according to the “What’s Going On In Banking” report. High-yield savings and certificates of deposit might be a way to attract hot money, but the real driver of a low cost of funds will be garnering core deposits via checking accounts.

Many of our credit unions are trying to grow membership by chasing new, younger demographics to fuel deposit growth. Hence, the need to improve the consumer digital account origination experience.

But didn’t we start off by revealing that CUs have been aggressively deploying consumer digital account origination for five years? So why are we not seeing the results? Three themes: member experience, high abandonment and alphabet soup. Here’s what is getting lost in translation.

Dude, I Am NOT a Terrorist

Let’s start out with the alphabet soup that comes along with being a credit union. FFIEC, FinCEN, BSA, AML, CIP, KYC, CDD, EDD and USA PATRIOT Act are all important agencies and regulations to safeguard America. Too often, though, we see new member account origination that not only cites these regulations but also asks a lot of questions that turn a prospective member off from your CU.

Certainly, a credit union must verify that the person applying is an upstanding human and that the person behind the screen is that same human. The great news? There is technology that can do that task for you.

Use technology like Alloy or some other tool to help prove a potential member is who they say they are. In doing so, your CU will avoid asking the many questions that digital-first institutions don’t pose up front to potential customers. Also, stop with the out-of-wallet questions. These stink for those younger members you are targeting because they don’t have a mortgage or auto loan to verify their identities. P.S. These types of questions also frustrate divorcees and people with similar names to their parents.

Don’t Abandon Me

Over the pandemic, we conducted a study of 184 banks and credit unions deploying digital account origination and uncovered horrendous abandonment challenges.

For retail deposit accounts, the average abandon rate was 55%, while 43% of those abandonments happened at qualification. While that sounds bad, it might not be bad for the qualification abandonment rate at least—maybe they are not eligible for membership at your credit union, for example. Interestingly, 22.7% of those abandonments happened at funding. If your credit union requires ACH micro-deposits, which add steps required of your would-be member, then that abandonment number jumps to more than 30%. Why is it so hard to allow funding from a credit card or another bank account?

If you plan to have a team member follow up with an abandoned application, our study found that there is 0% lift from human follow-up. Maybe don’t waste the effort because, as Eminem sings, “You only get one shot.”

Also, not everyone should be a member. Our study showed that the average decline rate is 29.75%. That’s OK—filtering out unqualified membership can be a good thing for the health of your CU.

The buzzword bingo winner last year for us was “digital transformation.” That phrase implies that transformation is done at some point, but we don’t think it ever ends for credit unions. It’s still early days this year, but we are leaning in on “member experience” as the new buzzword bingo-winning contender. Look to challenger banks to see what a strong member experience resembles.

Has anyone at your credit union opened an account with Chime, SoFi, Varo or any other digital-first institution? Have you snagged screenshots and shown them at a leadership meeting? If so, did you do a side-by-side with your own digital account opening?

If you did, then you might see where we are going with the challenges we note when comparing the member experience of opening an account with a traditional credit union to doing the same thing at a digital-first player. Look at Chime’s landing page. The first screen only asks for First Name, Last Name and Email.

Now, ask your team if you have alphabet soup disclosures and abandonment rates like the ones in our study when someone is trying to become a member. See if your member journey matches that of SoFi, a firm that can open a deposit account within minutes and fund more than 80% of consumer loans applied for by 7 p.m. that same day. Oof, now that’s member experience.

Get With the Program

Too many institutions are missing the beat when it comes to improving the digital account origination experience. Given the pandemic effect on branch traffic, consumer behavior has permanently shifted. Credit unions must find a way to attract and retain deposits to remain competitive and grow membership, especially if they want to woo younger members (and we know you do).

If the online account origination process takes too long, requires too much data entry or puts additional friction on the system, those members will seek easier experiences with digital-first institutions that offer similar products with a smoother experience. cues icon

John Meyer is senior director with CUESolutions provider Cornerstone Advisors, Scottsdale, Arizona. He leads the firm’s business intelligence and data analytics practice. In this role, he helps community banks and credit unions better use the data they have to make smarter decisions with risks and opportunities.