9 minutes

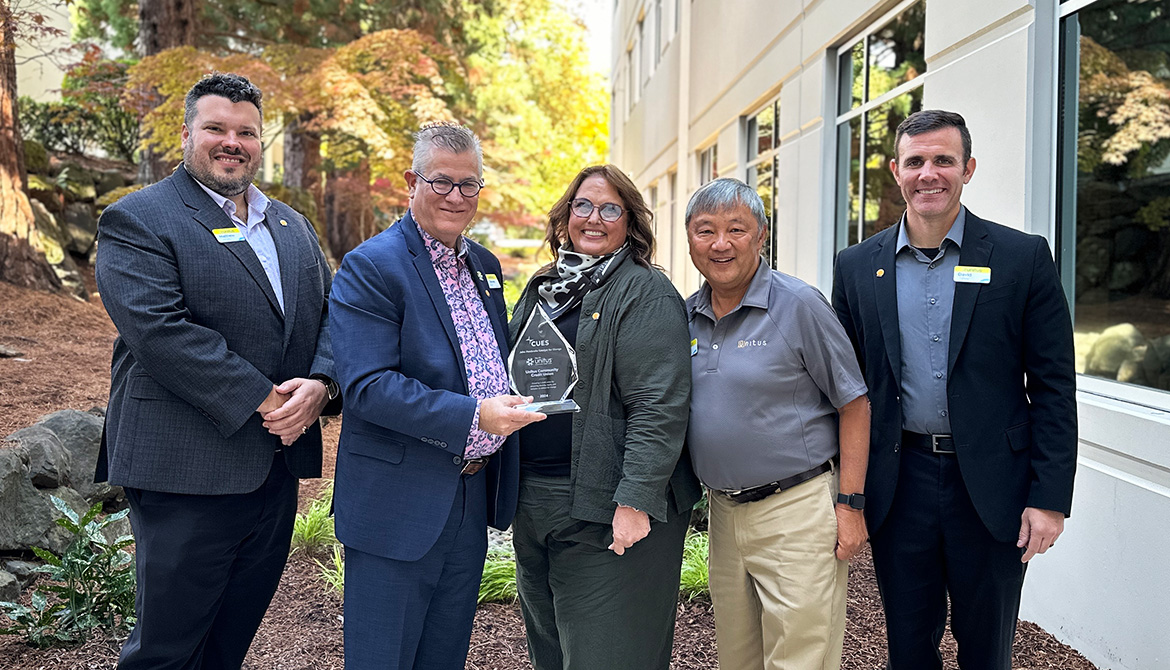

Unitus Community Credit Union Embodies DEI Ideals as the Recipient of the 2024 John Pembroke Catalyst for Change Award

Both within and outside its walls, Unitus Community Credit Union demonstrates an unwavering commitment to diversity, equity, and inclusion. The $1.7 billion credit union, based in Tigard, Oregon, has developed a comprehensive DEI Action Plan that fosters an inclusive work environment for its employees, addresses the needs of a diverse membership, and acts as a force for good in the communities it serves. Employees throughout the credit union champion these ideals.

“That’s our secret sauce,” said President/CEO Steven Stapp. “It’s not just any one person who is responsible for our efforts. It is the entire organization. We look at everything we do through a DEI lens, from our products and services to even the design of our new corporate facility.”

As a result of its efforts, Unitus was named the recipient of the 2024 John Pembroke Catalyst for Change Award, an honor that commemorates the late president/CEO who was passionate about advancing DEI in the credit union movement. CUES bestows the award to recognize a credit union that has demonstrated sustained support for advancing DEI in the workplace, raised awareness of workplace diversity and inclusion, and supported positive change within the industry, their organization, and their community.

For Stapp, the recognition is even more meaningful because of the award’s namesake. “I knew John Pembroke,” he said. “I attended CUES courses with him and always found him to be an inspiration. It’s appropriate this award was named after him because I know how devoted he was to this work. Receiving the award is an honor that reflects what he did in his career and what we as a credit union are doing in DEI for our staff, our membership, and our community.”

Part of Its DNA

Unitus’s commitment to DEI principals predates the use of the acronym. “It’s part of our DNA,” Stapp said. “We were founded as a telecom credit union in 1937. Even then, we were diverse. About 20 years ago, we became a community credit union, and that allowed us to focus on the DEI needs of the entire community.”

As a community credit union, Unitus serves the entire Portland metro area as well as parts of southwestern Washington. Its membership stands at 105,000. “Because of our outreach efforts in the community, we’ve seen our membership grow,” Stapp said. “Our Hispanic membership in particular has grown over the last five years by about 40%.”

In keeping with its DEI Action Plan, Unitus accommodates the needs of its Hispanic membership by providing Spanish language resources. “Of our 330 employees, 50 employees are bilingual in Spanish,” Stapp reports. “A lot of our community events are bilingual, as are our forms and website. We were the first credit union in the Pacific Northwest to launch a Spanish-language chatbot to help our members as well.”

Stapp gained a global view of DEI during his seven years as a board member of the World Council of Credit Unions, including a two-year term as board chair from 2018 to 2020. “I was provided a unique opportunity to see what was happening in the world,” he said. “As I brought concepts about DEI into our organization and we began to look at how we could be a catalyst for change and diversity, our staff began bringing up many of the same concepts.”

Unitus formed a DEI Employee Committee to facilitate staff involvement in these issues. The 10-person committee works collaboratively with the DEI Executive Steering Committee, consisting of the five executives who have been tasked with furthering the DEI goals of the organization.

“The steering committee is responsible for the DEI Action Plan, but in the interest of full transparency, we have an attendee from our DEI Employee Committee join our meetings so that they can see what we’re working on, and then we share that information out,” Stapp explains. “We also share that information with our board governance committee, and the board governance committee reports back to us, so that we get 360-degree visibility of what’s happening at our organization.”

Recently, Unitus added a fourth word—access—to its DEI Action Plan. This added word reflects the credit union’s belief that all people should have access to financial services and capital. Internally, Unitus gave “access” top consideration when designing its new corporate facility, breaking down barriers to make the physical environment more accommodating and open to all employees.

“We lowered the hierarchy,” Stapp said. “Our executive team is not separated from other employees. We’re not on different floors. We don’t have corner offices. We’ve taken the corners in our new building and designed them as meeting places for all employees because it reflects the work that everybody is doing throughout the organization.”

The commitment to diversity is reflected in the demographic makeup of Unitus’s staff, with over 40% of new hires coming from the Black, Indigenous, and People of Color (BIPOC) community. The credit union’s Multiculturally United Employee Resource Group has been instrumental in celebrating this diversity. “They hosted a heritage potluck the week following International Credit Union Day, which gave the staff a chance to showcase their diverse backgrounds and cultures,” Stapp reports. “The event created an important dialog about acceptance and inclusion.”

Unitus’s seven-person board of directors also values diversity. “The board itself has been intentional in achieving diversity,” Stapp said. “Each year, they do a demographics and skills assessment. Not only do they look at skillsets and life experiences, but they also look at gender, ethnicity, age, and where they live geographically to ensure that we have a well-rounded board that represents our communities. We’ve had board members step down to fulfill that commitment and responsibility to our community.”

Community Commitment

Commitment to community is central to Unitus’s DEI Action Plan. As a low-income designation credit union, Unitus has become an important resource for improving the financial lives of people in the communities it serves. The credit union also has a Juntos Avanzamos designation, indicating its commitment to supporting the Hispanic community through service and education aimed at creating a more inclusive financial system.

“We work with about 120 community partners, and 40% to 50% of those are related to serving our underserved community,” Stapp said. “We’ve worked with our Hispanic community, and we’ve worked with our Black community, partnering with them not just in charitable giving but also in performing service for those particular organizations.”

Unitus also works with credit union associations that help promote diversity within the industry. In addition to CUES, those organizations include the National Association of Latino Credit Unions & Professionals, the African-American Credit Union Coalition, and CU Pride. “We’ll soon be a joiner of HAPICUP, which is for Hawaiian, Asian, Pacific Islander credit union professionals,” Stapp reports. “We also work closely with the Hispanic Metropolitan Chamber. We have leaders who go through their leadership training program.”

The credit union’s commitment to DEI has had a significant impact on its philanthropic activities. “Locally, the Portland Business Journal has named us a top philanthropic giver in our community,” Stapp said. “Only a few credit unions are named to that list in a given year, so we’re proud to have made the list 14 years in a row. As part of our DEI commitment, we’ve diversified our community giving. We shifted our dollars so that now we give 30% to 40% to diverse organizations.”

In addition to its philanthropic giving, Unitus supports its community through the volunteerism of its staff. “Annually, we’re always in excess of 1,500 hours of community service,” Stapp said. “We have worked in collaboration with other credit unions through the Urban League of Portland, doing outreach work with them and education. We also work with many Hispanic organizations in our community.”

Much of Unitus’s volunteerism occurs on a day of service to honor the late Barbara Leonard, who served on the board for 20 years and was the organization’s first female board chair. “Barbara was instrumental at the time we transformed from a telecom credit union to a community credit union,” Stapp said. “Her vision was that we would serve all people within our field of membership. We feel that we now embody the values that she set forth for us.”

A Cultural Exchange

Another way that Unitus has advanced its DEI initiatives is by participating in an exchange program launched by Stapp during his tenure with the World Council of Credit Unions. The program entails onsite visits between credit unions from different countries so that participating employees can share knowledge, ideas, and insights.

“We did an exchange with New Zealand credit unions, which allowed us to watch how they work with their Māori indigenous communities,” Stapp reports. “We also have worked closely with credit unions in Mexico, learning about the challenges they face. Our participation in these exchanges has helped my executive team and board gain an understanding of how to improve our outreach to our community.”

One of the lessons that Unitus has learned through participating in these international interactions was to take the lead in community events. Often these events coincide with cultural celebrations such as Black History Month and Hispanic Heritage Month. For the past three years, Unitus has stepped up its efforts by hosting El Festival de Mariachi, a festival that celebrates unity and Hispanic culture in honor of Hispanic Heritage Month.

The festival is held at Hillsboro Ballpark, home of the Hillsboro Hops, a Single-A baseball team. In addition to showcasing the talents of several high school mariachi bands, the festival features an array of food booths and vendor booths showcasing local merchants. It’s through events like these that Unitus has gained recognition for its widespread community support.

“We hear from our community members and elected officials that the credit union is serving a vital part of the community fabric,” Stapp said. “The individuals coming to these free events are finding spaces that they can participate in and be with each other in a safe, fun environment.”

Advice for Other Credit Unions

Many credit unions are still at the start of their DEI journey. Stapp recommends that they reach out to peer credit unions to gain insights into how best to set and reach their DEI objectives. He also recommends that they participate in DEI-related industry events. “The NCUA puts on a very good DEI Summit, which brings credit unions together to share their ideas,” he said.

Most importantly, Stapp stresses the value of creating a comprehensive action plan to guide your credit union’s DEI initiatives and ensure that progress is never-ending. “The plan is the mechanism for holding yourself accountable,” he said. “We don’t ever feel like our work in DEI is done. We’re constantly challenging ourselves to improve.”

Diane Franklin is a longtime contributor to CU Management magazine.