4 minutes

Identifying & Reporting Fraud with Confidence

Fraudsters are getting smarter, but so are we. Every day, scammers find new ways to manipulate trust, urgency, and confusion to deceive their victims. That’s why understanding the difference between fraud and scams—and knowing how to classify them—is more important than ever. The Federal Reserve’s FraudClassifierSM and ScamClassiferSM models provide a structured approach to identifying and reporting fraudulent activity, helping financial professionals stay one step ahead. The January edition of First Line of Defense, powered by CUES partner TRC Interactive, breaks down real-world scenarios so you can sharpen your fraud detection skills and protect your members.

We already know that fraud and scams come in all shapes and sizes. But do you know the difference between fraud and a scam? Fraud is a broad term for any activity that uses deception or dishonesty to gain anything from information to opportunity to money. A scam is a subset within fraud, where the deception is specifically intended to achieve financial gain.

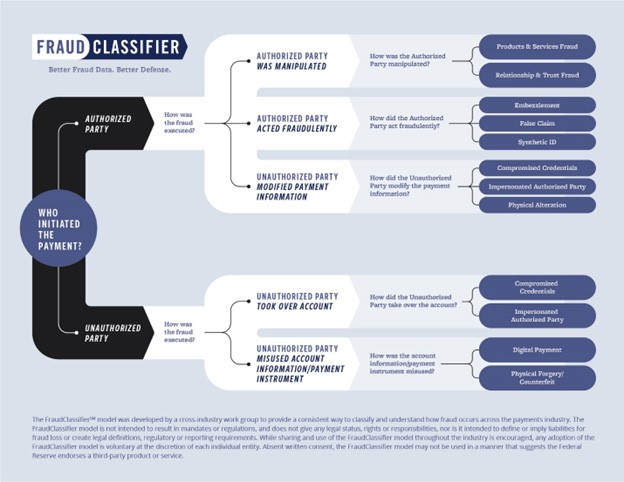

To standardize and improve fraud reporting, the Federal Reserve released the FraudClassifierSM and ScamClassiferSM models in 2023 and 2024, with each model taking you through four steps to understand what occurred and classify the type and impact as you report it.

Let’s walk through a few example scenarios, and how the models can be used to stay alert and informed on fraud and scams.

Scenario: Requesting Cash

Your member has asked for $2,500 in cash. When you probe a little further, they say it’s in response to a phone call from the IRS requesting immediate payment. Although they were unaware they owed anything, they want to right the situation as quickly as possible.

You know from your fraud training that the IRS will always send the bill through the mail. After keeping your member from becoming another victim of fraud, you’re ready to classify and report.

- Does this fit the definition of a scam? Yes. The scammer was attempting to receive cash from their victim.

- Who authorized the payment? The ScamClassifierSM offers two options: an authorized party made a payment, or an authorized party enabled unauthorized account access. Your member was not providing access to their account, but rather making a payment, which makes this an authorized payment.

- What is the scam category? By looking at how the victim was deceived, you classify this as either a Products or Services scam, or a Relationship and Trust scam. Products and Services relies on victims buying products that don’t exist, while Relationship and Trust has scammers posing as businesses, organizations, or other trusted parties requesting money. The scammer claimed to be from the IRS, relying on your member’s trust in government agencies to respond. This is a Relationship and Trust scam.

- What is the scam type? Now that you know the category, you can further narrow it down to the type of scam, such as Merchandise, Property Sale, Bank Imposter, or Investment. This particular imposter is a Government Imposter.

Scenario: Phishing

“Phishing” is when a fraudster attempts to receive sensitive information or gain access to a device through the use of compromised links, forms, or similar digital assets. You received a text about a delivery you missed, with a link to take care of it. You also got an email that there’s an issue with your Amazon account, with instructions to click a link to sign in and access customer service.

These attempts rely on a flustered victim acting urgently, not paying attention to who is sending the message or thinking critically about usual methods of resolving similar situations. Because you’ve run across similar scenarios in your First Line of Defense trainings, you don’t click any links.

Does this fit the definition of a scam? No. While we often refer to “a phishing scam,” the activity isn’t a direct attempt to receive money, but rather a fraud attempt to compromise a device or credentials. You can now use the FraudClassifierSM model to see how this phishing attempt could have led to an unauthorized party accessing the account with compromised credentials.

Fraud and scams are constantly evolving, but with the right tools and knowledge, we can stay ahead of bad actors. By leveraging resources like First Line of Defense, financial professionals can confidently identify, classify, and report fraudulent activity—protecting both their institutions and their members. Continued education and vigilance are key to strengthening our defenses. Stay informed, trust your training, and remember—when something feels off, it’s always worth a second look.

As the Products & Services Manager at CUES, Sharon Messmore supports credit union leaders in their pursuit of professional development. By implementing and managing premier products, she takes care of the details so that they can focus on developing to their full potential. Sharon is passionate about using her communication and project management skills to serve the non-profit industry.