4 minutes

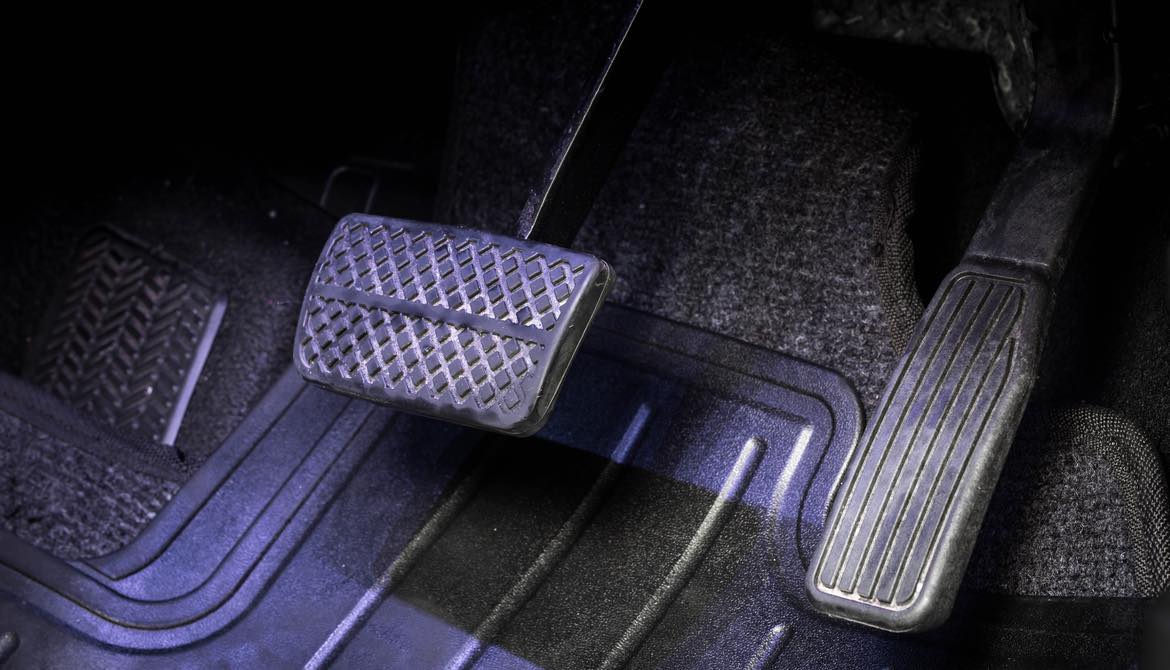

Will he be like his predecessors—with one foot on the gas and the other on the brake? What’s likely in store for credit unions and banks.

Quantitative easing bloated the Federal Reserve’s balance sheet by $4 trillion under the chairmanships of Ben Bernanke, Ph.D., and Janet Yellen, Ph.D. According to St. Louis Fed data, only 29 cents out of $1 of QE ever got to market. The Fed purchased bonds from financial institutions with the hope they would take the cash from the sale and make loans. Yet at the same time—from 2008 to the present—the Fed has imposed substantial increases in capital and liquidity regulation. This forced financial institutions to keep over 70 percent of the cash from bond sales on their books.

So, will Jerome Powell—if confirmed as Fed chair after being nominated Nov. 2—continue the same monetary policy as his most recent two predecessors? Will Powell oversee government-sponsored enterprises Fannie Mae and Freddie Mac, but do as his predecessors did—nothing to get rid of them or improve them? Will Dodd-Frank continue as-is or will the Powell Fed recommend changes? Will he consider the largest credit unions as risks to the money system? Will tax reform benefit the Powell Fed?

Let’s see what Powell has done and what he can be expected to do.

Here is some of Powell’s background:

- He earned his law degree from Georgetown University. This contrasts to the four preceding Fed chairs, over the last 38 years, who hold Ph.D.s in economics.

- Powell worked eight years for Carlyle Group, a private equity firm. This gives him hands-on experience in the private sector, but also could cast him as being part of Wall Street.

- He is a Republican but was appointed to the Fed by President Obama. Does that mean easy Senate approval?

- He is the only current potential chair of a regulatory institution with industry experience during the creation and implementation of the Dodd-Frank Act, giving him an understanding of current regulation.

- Powell has a strong relationship with Randel Quarles, also a member of the Fed’s board and vice chair of Fed Banking Supervision. Powell and Quarles worked together at Treasury and the Carlyle Group.

- In speeches, writings, and recent Senate hearings, Powell has shared the following insights on his view of regulation:

- Big banks need to have more capital with living wills, to provide a clear path through any bankruptcy, and stress testing needs to continue and be better. A key question: Will the largest credit unions now be required to do living wills as well?

- Smaller financial institutions need less regulation.

- Regulation since 2008 is too complex and needs to be simplified.

- CFPB compliance is a Congressional, not a Fed, matter.

What could be the expectations under Chair Powell?

- Fannie Mae and Freddie Mac could be replaced with a private sector approach. Powell being a lawyer with private sector experience, plus his relationship with Quarles and support from the Secretary of the Treasury Steven Mnuchin, makes this very likely. The mortgage banking industry, small banks and credit unions, and the home-owning public could really benefit from this because of the high inefficiencies of the GSEs.

- Regulation simplification would be high on Powell’s agenda, especially for community banks and credit unions. This could reduce the increased burden of high regulatory expenses at small financial institutions that are far from a systematic risk to their markets or financial system.

- Powell will expand regulation by including a few more financial institutions that pose systematic risk (large credit unions and thrift depositories) and requiring better stress testing and improved living wills.

- Monetary policy might continue to include raising rates. Lawyers tend to take fewer risks than economists, so rate increases may be infrequent. Let’s hope Powell shifts to supply-side or monetary approach instead of maintaining the focus on price. This would help small businesses and consumers who are still underwater in the mortgages on their homes.

- Correcting the Fed’s bloated $4 trillion balance sheet may very well be at the bottom of Powell’s agenda. His approach could be to let fiscal policy get the economy going and then sell the Fed’s bond portfolio.

- The Powell Fed could benefit from tax reform as fiscal stimulus.

Powell appears to be President Trump’s best choice to enact monetary and regulatory policies benefiting small businesses, the consumer, community banks and credit unions. Time will tell.

Mike Moebs’ economic research firm, Moebs $ervices, Lake Forest, Ill., has provided data, information and intelligence to government agencies, news outlets and thousands of financial institutions. The former credit union director and bank director holds several patents on risk management for loans and overdrafts.