3 minutes

Take good care of each of these four pillars.

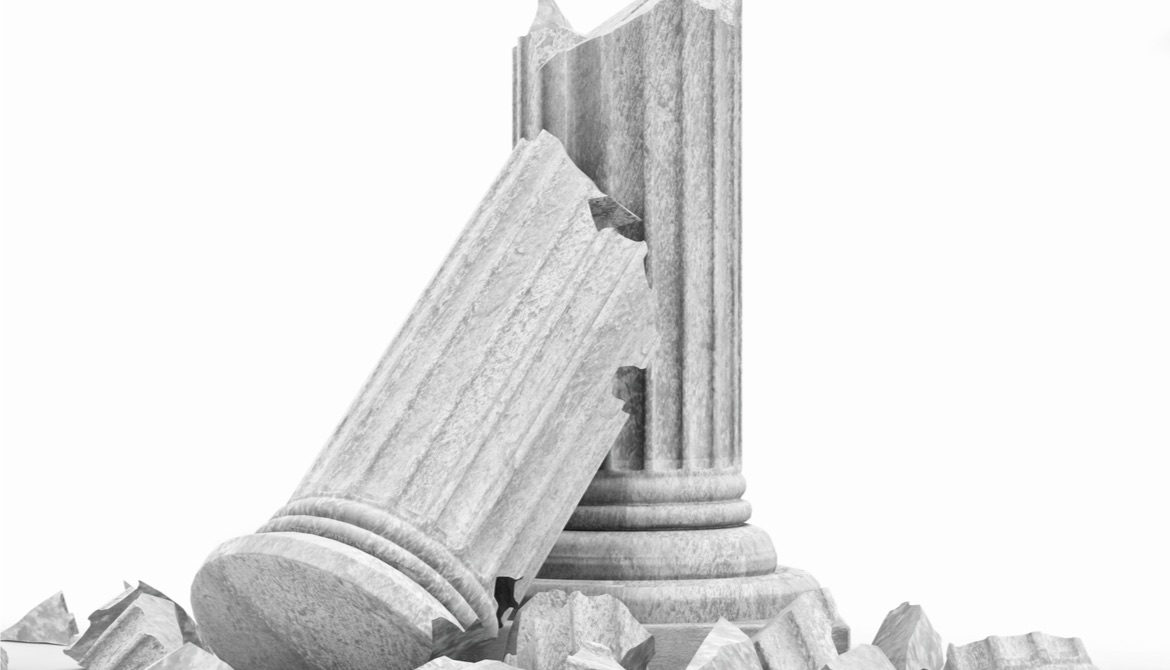

Studies show it costs between five and 10 times as much money to win a new member as it does to retain an existing member, leaving no doubt that client retention has significant benefits. At the center of any client retention effort is the relationship management strategy. A sound strategy can be built with four pillars of relationship management, which represent organizational processes to focus on enhancing member retention efforts, regardless of which loan products or services you deliver.

1. Onboarding and training. Retention begins at the exact moment a member joins, signs a loan application or applies for a credit card. In financial services, onboarding typically includes introducing the member to credit union representatives and showing them how to use their new tools. These might include an introduction to the CU’s online and mobile services and branch/ATM network. Onboarding is the strategy for bringing the new member into the family, so to speak. It involves showing them for the first time how much you appreciate their business – so much that you are invested in making sure they get off to a wonderful start. Your CU’s member services and support teams are absolutely critical to this effort, as they represent the face of your organization. Never take onboarding for granted. Always test members’ experiences to ensure that service levels are high and satisfaction is not slipping.

2. Retention. Once the member is on board and has become accustomed to using your credit union’s services, shift to retention mode, which focuses on continuing to show members that they are appreciated. For lending officers, member retention may include making phone calls and attending business mixers. Do anything you can to make your members realize they are valued contributors to your credit union, and that they have a voice when it comes to new products and services. Give them a seat at the table via focus groups and other feedback channels. An important part of the credit union difference, C-level executives also need to offer members a pathway for venting frustration or contributing ideas.

3. Employee hiring, training, and communication. Great sales people can attract new members, but to keep them you need great employees that can manage the relationships. It is also important to have a strong employee training program for these teams. Like members, employees must know that they have a voice when it comes to service levels, problem resolution and C-level interaction. The best way to enhance staff retention is to hire great people, train them effectively and empower them to make client-level decisions on your behalf.

4. Credit union culture. The credit union culture absolutely permeates everything that has been stated above. A mission statement is one thing, but it must be backed by thoughtful action from every employee. Employees must be empowered to take necessary actions to develop and enhance relationships with members.

The long-term goal of any relationship management effort is to establish and strengthen these four pillars over time. If member satisfaction begins to slip, you can almost bet that one of the four pillars has a crack, and it is time to discover and repair the reason for that failure. As you can see, these pillars impact every employee of your credit union as well as your members. As you enter a new year, may your four pillars remain strong, and may you enjoy wonderful, intentional success in 2018.

Patrick True is risk manager with the lending solutions division of ProfitStars®. A 25-year veteran of the financial industry, True is the author of numerous banking journal articles and frequently published on Jack Henry & Associates’ Strategically Speaking blog.