2 minutes

Consolidations are one component of this season of assessing balance sheets and strategic growth plans.

I read with interest the “Deposit Dilemma” article in Invictus Group’s recent Bank Insights newsletter, which asserts that the current economic situation is pushing more banks to boost their deposits through an unconventional means: mergers. I emailed mergers expert Glenn Christensen, asking “Is this what you’re seeing among credit unions, too?”

President/CEO of CEO Advisory Group, Lake Tapps, Wash., Christensen replied that he was seeing some parallels in the credit union industry—and offered the following additional thoughts:

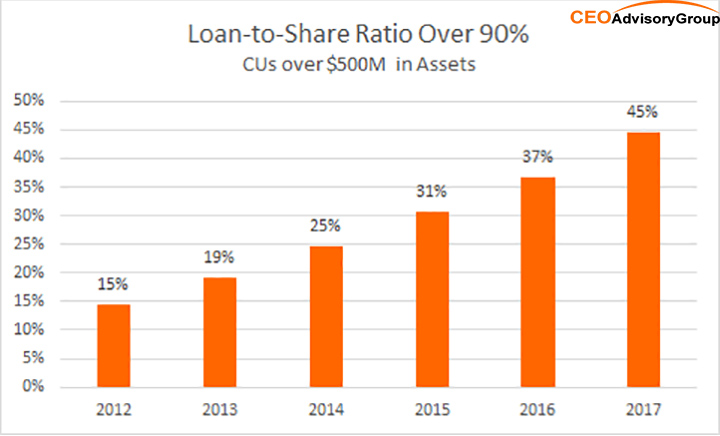

As illustrated in the chart below, the number of credit unions with loan-to-share ratios exceeding 90 percent has tripled in the last five years among credit unions with over $500 million in assets. Among these credit unions, the average loan-to-share ratio has increased from 70 percent to 85 percent.

As illustrated in the chart below, the number of credit unions with loan-to-share ratios exceeding 90 percent has tripled in the last five years among credit unions with over $500 million in assets. Among these credit unions, the average loan-to-share ratio has increased from 70 percent to 85 percent.

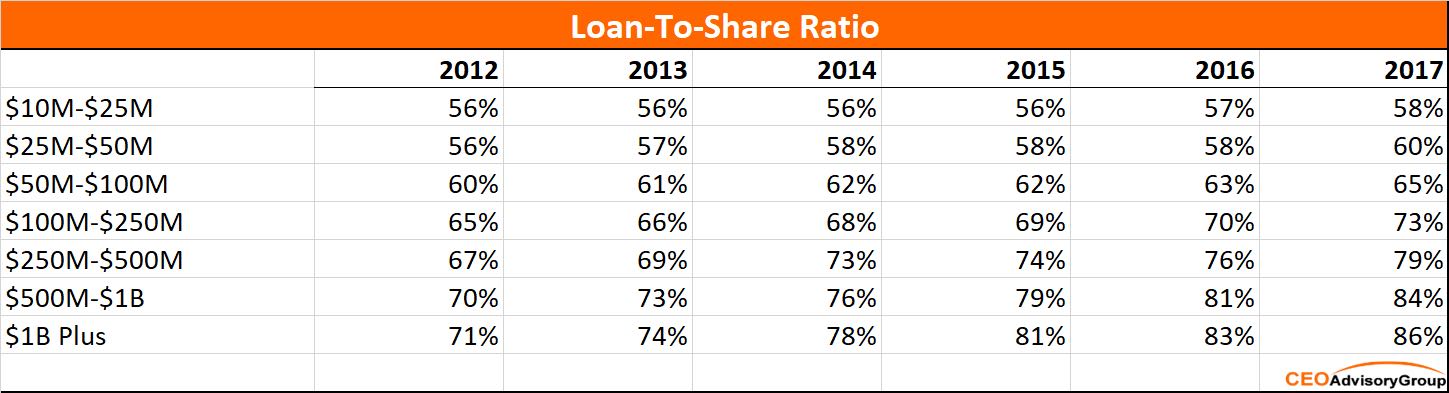

The last five years have been the best of times for credit union lending. Unfortunately, smaller credit unions, those under $100 million, have not been able to capitalize on the favorable lending environment to the same extent as larger credit unions. During this time, smaller credit unions have seen their average loan-to-share ratios climb less than 5 percent. Consequently, the disparity in loan-to-share ratios has continued to grow, causing more pressure on smaller credit unions.

Because many credit unions are reaching their loan-to-share threshold, an increasing number of larger credit unions are seeking merger partners that have excess liquidity—a partnership that can benefit both credit unions.

Looking to the future, it will be essential for credit unions to consider altering their geographic, demographic and psychographic target market strategies to diversify their funding and loan portfolios. Mergers are an efficient method to accelerate entry into new market segments. Credit unions with strong business models have the opportunity to leverage those models in new markets. Some seek to enter rural and mature markets with limited competition where they can make, in partnership with another credit union, an immediate impact that benefits the partner credit union as well as the consumers in the market.

In this season of assessing balance sheet strategies and strategic growth plans, mergers and acquisitions can offer an important element in credit unions’ future success.

Lisa Hochgraf is senior editor for CUES.

CUES Unlimited+ and CCUBE members can also read “9 Ratios for Evaluating Whether Your CU Should Consider a Merger,” also by Christensen.

Also read “Shades of Merger Gray,” by Steve Morrissette, faculty for Strategic Growth Institute at the University of Chicago.