8 minutes

Watch out for the impact of inflation on your—and your employees’—retirement funds.

Cyberattacks, shifting regulations, rising income taxes, insufficient employee participation and deferral rates: The headwinds against successful achievement of a retirement plan’s goals seem endless.

In an era of skyrocketing fiscal deficits, the probability of employees having to pay higher tax rates on income drawn from a standard 401(k) is rising. Likewise, recent cyberattacks were of sufficient impact to force plan sponsors and service providers to implement additional data security measures. These two risks alone are cause for vigilance, but thankfully their probabilities are still outliers.

One risk is certain: A thief will progressively steal employees’ retirement savings. This thief has been getting a lot of attention lately, and plan sponsors need to focus heavily on stopping it in its tracks.

The thief is inflation.

The Current State of Inflation

Rising consumer prices have a knack for getting attention on Main Street. Higher fuel and grocery prices—the most volatile components of many inflation measures—tend to speak the loudest. Recent inflation data have been shouting because they have risen at rates not seen in many decades. In July and August, inflation was at 5.4%. The last time inflation was this high was in 1990. In 2020, the rate was 1.23%. Most of the year-over-year increases are due to base effects, but inflation is nonetheless running hot relative to any historical comparison or calculation method. A great debate among economists and central bankers now rages with one camp arguing inflation is temporary due to short-term post-pandemic conditions and the other arguing it’s permanent due to structural changes in the economy.

In reality, inflation is not a well-understood phenomenon. Theories that seek to explain it often rely on relationships between economic variables that aren’t linear or stable enough to create reliable cause-and-effect connections. The Phillips Curve that postulated a direct and almost linear inverse relationship between unemployment and inflation has proven to be particularly inexact. At Cuna Mutual Group, we believe current high inflation rates are mostly explained by temporary influences, but we have low confidence in our view. Only time will tell if the current trend of rising consumer and producer prices will pass quickly or stick around for the long term. Either way, the thief stealing retirement savings is currently quite active, and retirement plan sponsors and participants must guard the gate.

Inflation’s Impact on Retirement Savings

Inflation’s impact on long-term savings can be devastating. Loss of purchasing power often makes seemingly abundant savings accumulated over a lifetime entirely insufficient after a significant percentage is stolen by even modest amounts of inflation. Indeed, a meager 2% annual inflation rate would reduce the purchasing power of accumulated savings by about one-third over a 20-year period. The challenges are compounded during retirement because retirees no longer benefit from cost-of-living adjustments to their earned income beyond Social Security increases. Quality of life during retirement is at stake, so stopping the thief in its tracks is a worthy endeavor at any stage of the retirement planning lifecycle.

Plan sponsors can play an important role as defenders of retirement savings. Plan design and investment menu management are critical tools that can help sponsors enable their employees to keep the inflation thief at bay. Matching employee contributions in ways that encourage participation and adequate saving rates should be explored. Just getting the process of saving underway is a big step forward, even though it doesn’t directly fend off long-term losses of purchasing power caused by inflation. A proper investment menu fills that gap. More on that later.

What Retirement Savers Often Get Wrong

Retirement is an abstract concept for young employees. Being old is for old people, so why preemptively address the challenges associated with aging too soon? Add financial constraints that often accompany being young, and the stage is set for reluctance to participate in a retirement savings plan. Older employees often suffer from recency bias that makes current negative headlines look darker and more intractable than any experienced in the past. Constant risk avoidance is almost assured as one ugly headline is replaced by another. Given all of this, many employees struggle with saving, saving enough, and investing with a proper amount of risk. Inflation compounds the challenge by progressively raising the bar for achievement of financial security during retirement.

But the news is good. Self-defeating behaviors among young employees can be remedied by effective education and communication programs. Likewise, greater understanding of long-term risk and return concepts can reduce risk avoidance that makes inflation a big problem for older retirement plan savers. Success with both age groups is only limited by the vision and creativity of plan sponsors and their service providers.

Guarding Against the Thief

What’s the best way for an employee to succeed with their 401(k) plan? Participate. What’s the second-best way for an employee to succeed with their plan? Save enough. Yes, participate and save enough are still best strategies for success. Obviously, the decision to not save leads to no savings, so rule that option out. No investment can beat the guaranteed return—often a 100% return—provided by an employer match, so employees should at least save enough to achieve that return (saving more, of course, is even better).

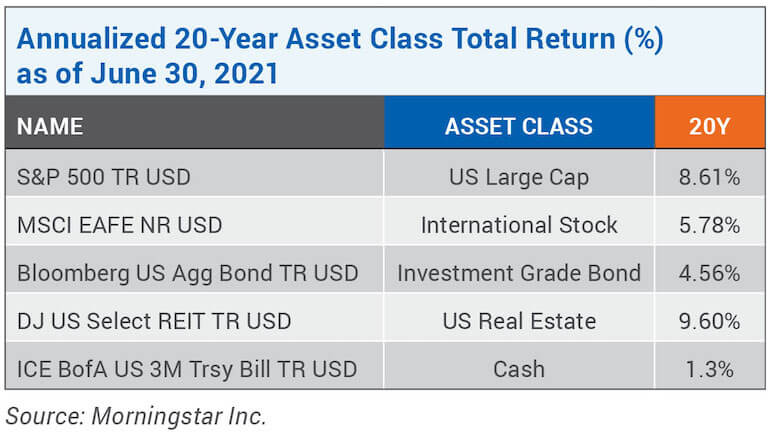

That’s good advice during the accumulation phase of a retirement savings program, but the damage inflicted by the inflation thief is most insidious on existing savings. As such, return on accumulated savings must outpace inflation if it is to retain its purchasing power. Here, plan participants can fall short simply by investing too conservatively. The table below presents 20-year major asset class returns:

As the table shows, returns ranged between high and low single digits with higher-risk asset classes mostly achieving the highest returns. The return on savings held in cash or money market accounts was a mere 1.37% annualized. Other investments with low or very low risk achieved similar returns. Disinflationary conditions, or a period when prices rose at decreasing rates, were mostly present during the reporting period, especially in the aftermath of the 2008 financial crisis. According to InflationData.com, annualized inflation between 2010 and 2019 was 1.75%. So, even disinflationary conditions took a meaningful bite out of investment returns on accumulated savings during the last decade. Investors who took no or very little risk experienced negative real returns. The thief strikes!

Assume for a moment that the past is prologue and investment returns shown in the table continue for the next 20 years (they won’t, but assume they will for this exercise). According to Bloomberg, the U.S. Labor Department reported July 2021 year-over-year inflation was 5.4%. Now assume continuation of July’s inflation rate into the longer-term future. Suddenly expectation for negative real returns reaches very far out on the risk spectrum. The assumptions supporting this exercise are bold to say the least, but negative real returns for investors who avoid risk are highly likely. Indeed, negative real returns on more conservative investments are almost certain if current rates of inflation turn out to be stickier than we currently expect.

Plan sponsors must assure their investment menus enable diversification, are simple to understand and provide sufficient inflation protection to keep the thief at bay. Overly complex investment menus tend to lead to overly conservative investing by plan participants. Ironically, an exotic commodity fund or inflation hedge on a plan’s menu could lead to greater exposure to inflation as participants seek refuge from options they don’t understand and invest in simpler alternatives that are guaranteed. If nothing else, plan sponsors must have confidence that the qualified default investment alternatives—the default investments used when employees do not specify how their funds should be invested—in their 401(k) plans provide adequately high expected protection from the long-term impact of inflation.

Can the Thief Steal My Defined Benefit Plan?

Defined benefit plans have a natural immunity against inflation. Usually, high inflation rates occur against a backdrop of robust economic growth and rising interest rates. As such, lost purchasing power attributable to inflation is often offset to some degree by rising discount rates used to calculate the present value of a plan’s liabilities. In a perfect world, the impact of inflation would be equal on the asset and liability sides of the equation, thereby eliminating any response in a plan’s funding ratio. Given this relationship between rising inflation and discount rates, defined benefit plan sponsors can rest easier versus 401(k) plan sponsors whose employees don’t benefit from this natural immunity.

This isn’t to say a defined benefit plan sponsor can ignore inflation entirely. An environment of rising inflation and persistently low interest rates, also known as a period of stagflation, can be particularly difficult. Stagflationary conditions often cause losses in financial markets while increasing interest rates customarily associated with rising inflation are missing. Under such conditions, assets fall in response to inflationary pressures without accompanying support to funding ratios provided by falling liabilities. Most defined benefit plan sponsors adopt total return strategies that seek to maximize investment return per unit of risk rather than a direct liability hedge. Those sponsors in particular still need to keep inflation on their radar screen.

A Bold New World

The post-pandemic period has led to meaningful structural change in the global economy. Explosive growth in debt and deficits is now a feature rather than a flaw in the system. Likewise, central banks have implemented money printing programs designed to support and stimulate the economy after an incredible shock. If Milton Friedman was right and inflation is always and everywhere a monetary phenomenon, plan sponsors and their employees would be served well by guarding the gate against a growing thief. cues icon

Scott D. Knapp, CFA, is chief market strategist at CUESolutions provider Cuna Mutual Group, Madison, Wisconsin.