9 minutes

Tyndall FCU’s leadership focuses operations on giving members what they want most.

A single mom working two jobs with bills to pay and expenses for the first day of school fast approaching. An entry-level cook for a chain restaurant who needs a car to get to work. A cleaning person who has never been in a position to save.

These people are the backbone of credit unions like $2 billion Tyndall Federal Credit Union, based in Panama City, Florida, where more than half of our 114,000 members are considered “low income.” How they pay their rent, how they buy new tires, how they cover daycare, how they make ends meet—these thoughts should be driving our strategies and decisions as leaders of the credit union system.

But credit unions are at risk of forgetting from where they came: not for profit, not for charity, but to serve. We need to get back to these basic principles.

The public largely does not realize the substantial impact credit unions make in communities across this country and especially for low-income members. We do not exist to make the rich richer; we help families survive financially and build a brighter future. We are different from traditional banks in several key ways, with the most significant being our not-for-profit status, which provides tax benefits, but also a profound responsibility to deliver meaningful value.

Delivering “value” should not be an ambiguous goal that can be easily claimed. Rather, it is vital credit unions determine the precise type of value their members need—and deliver on it.

That’s more easily said than done, but it is possible and should be fundamental to tracking credit union effectiveness and returns to members. The National Credit Union Administration monitors safety and soundness but only management can effectively monitor the credit union’s value to members.

Measuring Success in Serving Members

Tyndall FCU’s four simple measures of success are based on what our members want:

1) Our members want low fees. We charge fees totaling an average of $33/member annually. According to Callahan and Associates, our peer group charges $72. How do we do this? Our mortgage closing costs average $1,000 less than competitors’ fees; a member’s first courtesy pay every month is free, and subsequent overdrafts cost $20 each; and this year, we have dropped all account maintenance and insufficient fund fees for all members. The simple math is, our members benefit. Also according to Callahan and Associates, Tyndall FCU earned $4 million less in fee revenue from our members than our peers.

2) Our members want affordable loans. In 2021, Tyndall FCU earned $4.3 million less than our peers in revenue from member loan yield; in other words, our members benefited by over $4 million due to lower rates on their loans.

3) Our members want to get the most from their membership. To further maximize the value of membership, we also track the margin between our costs of deposits and loan yield to ensure we are running on the tightest margin possible. Clearly, this metric has limitations, but it adds to the overall picture of value delivered to members. In other words, we track our efforts to charge less for loans and pay more for deposits to minimize our income and therefore create more member value. By contrast, a for-profit bank endeavors to charge more for loans and pay less for deposits to maximize their income.

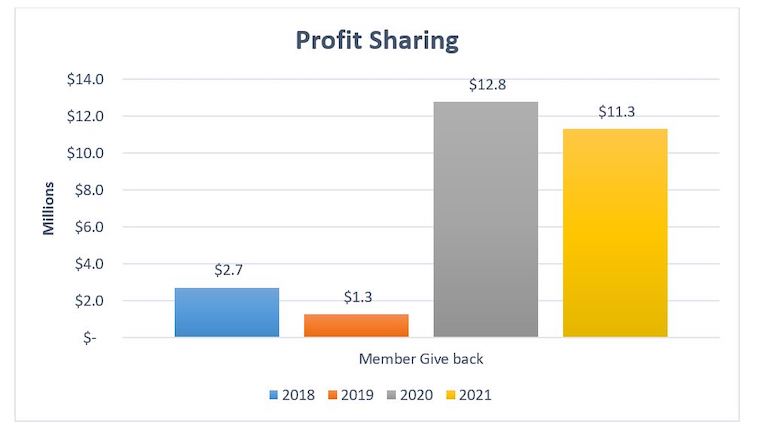

4) Our members want tangible financial help. Enter profit-sharing. In 2021, we distributed $11 million in profit-sharing to our members. Almost 50,000 members received between $50 and $400 the week before Christmas based on their use of key products and services. (And in the last three years, Tyndall FCU has shared $28 million in excess profits with our members.) Since we don’t use asset growth as a measure of success, we can afford to return excess profits to members and maintain a healthy net worth ratio of about 9%. Calculating member profit-sharing by product/service usage encourages future use of those products/services that are most desirable to create and sustain member value.

Operational Tenets That Support Delivering Value

At Tyndall FCU, our value-driven model is based on straightforward operational tenets.

1) Grow the right way. Growing assets by overpaying for deposits (liabilities) is not always a meaningful measure of success, especially when focusing on increasing value for all members. Inflating money market and CD rates will certainly go a long way in ensuring asset growth, leading to a significant—and impressive-sounding—total assets. But it is easy to become a hamster on a wheel, unceasingly scampering to boost levels of income to maintain the net worth ratio and further increase savings rates and acquire more and more deposits. For a CEO, this unrelenting search for sources of income can begin harmlessly enough (a little more loan yield here, a little more credit risk there, a few more fees on the back end), but can ultimately undermine the entire purpose of a credit union: to create, recreate and sustain member value. At the end of the day, deposits are inventory for the funding of member loans (we are, after all, a credit union, and not a savings union).

2) Waste not. Minimizing operating expenses is a primary key to our success at Tyndall FCU and a significant part of our model. It’s true that expenses are never easy to cut, but it is imperative to know and watch every dollar spent. We proactively cut our expenses from a position of strength, which shows on our financial reports: We spend $15 million less each year than our peers, according to peer data from Callahan. Those savings go directly back to our members in the form of better pricing or profit-sharing distributions. Additionally, expenses are becoming even more important as members change to digital service providers (such as fintechs) for better rates and lower fees supported by their low-cost operating model.

3) Don’t rob Peter to pay Paul. We focus on such outside sources of revenue as investments and interchange fees from merchants to drive value to our members. These revenue sources take pressure off charging more for member loans and/or fees and, when combined with lower operating expenses, support our ability to price products and services more aggressively in our members’ favor.

4) Protect Grandma’s money. When we give a member a loan, it is often funded by other members who have worked a lifetime on their savings and have entrusted it to us. Our ability to drive returns to our members rests, in part, on our ability to minimize loan losses. When a member can’t pay, we work with them. When a member won’t pay, we aggressively pursue all lawful means of collection. We protect our members’ money.

5) Give power to your people. A great credit union will come together if it is built on values and culture. Build a people-first organization from the inside out, which means constantly investing in your team and ensuring the entire organization is aligned with your purpose. Provide training on both soft skills and hard skills. Also, communicate often and openly. Create an ethos of “there’s nothing we can’t talk about.”

A Focus on Delivering Value to Members Starts at the Top

None of this means you can shy away from tough calls. Every credit union CEO bears a heavy burden, but perhaps none more important than our “duty of care.” Because of this burden, we all must drive our teams to perform, while leading with respect, ensuring effectiveness and requiring accountability. And those team members who cannot meet this standard must look for employment elsewhere.

This applies more to our executive team than our front line. It’s essential that you surround yourself with value-driven executives who fight for the membership, not for the bonus. It is simply unfair and unreasonable to allow underperforming employees (particularly those in higher-earning management roles) to continue in their jobs, for which the members pay them, when many in our membership are working hard and struggling to make ends meet.

It is important to ensure your board members have the proper measures of success. Our measures of success are simple: We charge less for loans and fees. We keep operating expenses low and deliver a trusted and increasingly self-service digital member experience.

Financial services are complex, competitive, risk-riddled, heavily regulated and in the midst of a technological revolution. As leaders in our organizations, we have a duty to our boards to be collaborators, leveraging their expertise and experience but also helping them hear the voice of our members and understand the true measures of success. If you do it right, the rewards can astound you.

It is no secret that in our industry, asset growth generally leads to higher executive pay. Tyndall FCU is a little different: Our board understands that asset growth is not an all-encompassing measure of success. Instead, our team, from top to bottom, is driven by delivering value to members—and they appreciate it! It is hard to describe the good feeling of seeing hundreds of exuberant social media posts after a profit-sharing distribution at Christmastime, and the feeling of satisfaction each of us experiences knowing our credit union made a difference for those who need it.

Jim Warren, MBA, CCD, CCE, is CEO of Tyndall Federal Credit Union headquartered in Panama City, Florida.