3 minutes

While regulations clarify, don’t sit on the sidelines. Learn all you can about this offering that’s in demand with young people.

Sponsored by Fiserv

What was once deemed a risky and perhaps short-lived fad, cryptocurrency has morphed into an important innovation in financial services—and it's here to stay.

According to the latest consumer research from Fiserv, 61% of millennials and Gen Z want their bank or credit union to hold cryptocurrency. In addition, Fiserv recently announced strategic relationships with Bakkt and NYDIG, two companies deep in the cryptocurrency business.

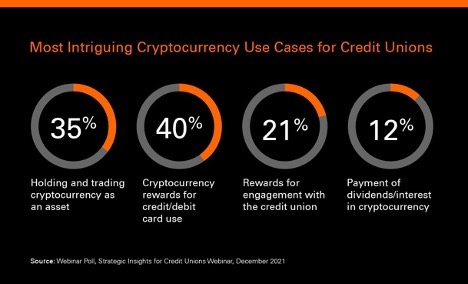

But are credit unions ready for cryptocurrency? Here are some insights into cryptocurrency and the opportunities it represents for credit unions.

Cryptocurrency Is Generational

There is growing mainstream curiosity and interest in cryptocurrency, especially among millennials and Gen Z. For example, research from Raddon shows that 56% of millennials and 46% of Gen Z are very or extremely aware of cryptocurrency, and a little more than half are very or extremely interested in receiving cryptocurrency as a dividend payment from their financial institution. With numbers like that, it now may be the time for credit unions to jump into the cryptocurrency pool as part of their efforts to attract and retain Gen Z and millennial members.

Hurry Up and Wait on Cryptocurrency

National Credit Union Association rules and regulations prevent credit unions from holding cryptocurrency, offering it as a dividend/interest, or being custodian of a member's cryptocurrency holding.

However, the NCUA issued guidance in December 2021 clarifying it does not prohibit credit unions from partnering with third-party providers of digital asset services that leverage evolving technologies. This includes facilitating member relationships with third parties that allow credit union members to buy, sell and hold various uninsured digital assets.

Even with the recent guidance regarding third parties, it appears credit unions themselves may not be quite ready to make the move to cryptocurrency, even if they were allowed to do so. A poll of more than 150 credit unions revealed that 38% are just starting to educate themselves about cryptocurrency, and another 19% are “watching and waiting pending clarity in the market and regulatory guidance.” Asked about the greatest challenge around buying cryptocurrency, 48% of credit unions responded they “don't know where to start.”

What Credit Unions Can Do Now

Michael Gotimer, product strategy advisor for Fiserv, a CUES Supplier member, recommends that while waiting for regulatory guidance, credit unions should continue to learn all they can, including understanding member demand.

Consumers may want their financial institution to hold cryptocurrency, but members don't appear to be sharing that information with their credit unions. The poll showed 79% of credit unions have received very few inquiries and only 3% are tracking inquiries.

Credit unions may want to begin thinking about strategic use cases for cryptocurrency instead of waiting until regulators give the thumbs up. Organizations that sit on the sidelines may miss out on important opportunities.

Consumers are already turning to third-party, nonbanking fintechs for services not offered by financial institutions. The Fiserv consumer research found that 69% of those who have bought or sold cryptocurrency have used a nonbanking app or website to do so. When the time comes, having a cryptocurrency strategy in place will be key for credit unions focused on attracting and retaining members, especially those from younger generations.

We’re still in the early stages of the cryptocurrency marketplace. As it evolves, it will be important for credit unions to stay informed from a regulatory, technology and member-demand perspective. In a state of awareness and readiness, credit unions will be able to take advantage of opportunities and deliver the products and services to keep members engaged and attract new members.

Theo Curey is president, credit union solutions, Fiserv, a CUES Supplier member. To understand more about how credit unions fit into the emerging cryptocurrency environment, download Three Cryptocurrency Actions for Financial Institutions.