5 minutes

If board composition and succession come up, you should talk about them now.

We at DDJ Myers sometimes need to ask board members or a board chair, “What are the historically unmentionable topics that your board should discuss?” In response, we often hear “board composition” and “succession.”

The way people frame the topics of board-level board composition and succession planning can make them difficult to discuss. Deflecting this important conversation might sound like:

- “Our board is performing well. Why do we need to talk about succession?”

- “Board succession means term limits. Term limits are a way for them to get me off the board.”

- “No one leaves our board; we don’t need succession.”

- “Change for the sake of change will take us off course.”

What is missing in these mindsets is an objective framework for boards to have grounded conversations about all of their practices. The idea behind conversations about composition and succession is to assess alignment and opportunity on key things that influence and impact board performance.

Getting the Conversation Started

One way to get people thinking about the value of looking at board composition and succession is to ask these two questions: “Will the governance requirements in the future be more or less?” and “Will our future board need more or less sophisticated governance practices?”

I’ve never had a board say that governing a credit union in the future will be easier. Additional questions that will begin to pry open the board succession conversation door include: “What would the impact be if we were more ready to embrace those challenges?” and, often tellingly, “What if we weren’t ready?...”

Start By Getting a Benchmark

When boards are interested in getting into a real conversation about succession, we recommend they do an objective assessment to benchmark their current state. Topics that come up as the result of doing such an assessment often include:

- a timeline of intentions for director transitions (people are always surprised that others are not only thinking about leaving the board but often know when they might do it);

- the desired future portfolio of talent/skills (the declared standard of needed skills in the future informs more topics than you can imagine);

- board member development plans that capture the individual’s desired learning and satisfy the future benchmark (a roadmap that empowers action); and

- clarity on expected director engagement (and yes, performance standards too).

Make no mistake, this is not an hour-long education session conversation. The succession conversation takes work and patience. I have to tell you though, one very high-performing CEO told me before one of our sessions, “If the board doesn’t put actions to their words, I’m going to be open to leading a different credit union.”

The good news is this CEO was blown away by the progress the board made. They did the work and held themselves accountable. We feel obligated to share that, based on the countless CEOs we work with, boards not doing their own development work leads to strain in the board and CEO partnership. Every. Single. Time.

Secondary Benefits of a Succession Conversation

Additionally, there are secondary outcomes of having succession and development conversations. We can set our watch to the following improvements:

- restructuring the board meeting agenda to discuss the most strategic items (usually scrapping “weeds” conversations);

- enhancing partnership and camaraderie among directors (getting in the trenches together builds trust);

- revamping the board packet (usually reducing the voluminous nature); and

- increasing attendance and preparation by directors (even punctuality!).

One of the most significant realizations our clients have is that board succession planning cannot be done during a weekend board retreat. There’s always more and sometimes that can be intimidating to directors. “Starting is half the work,” a board chair once said to me.

Succession Planning Is Strategic

Now is the time to put everything on the table and see how hungry the board is to leverage strengths, tighten coordination, sharpen strategic oversight, enhance oversight and partnership with the CEO, and establish a board succession process that would make your representative pool of members proud. Directors will transition off the board; it is just a matter of time. Having a strategically informed approach gives a board more options and reduces friction when it occurs.

Our clients implement an objective process that provides a quantified year-over-year self-assessment of governance progress against eight best-practice categories. As mentioned above, it takes work and time. With each repetition, the conversations and outlining action plans get easier because the board looks forward to identifying how to get better and what is next for alignment. Review what is important, let go of what no longer serves a purpose, and move forward aligned on the path for the future. The journey is as long as it is satisfying. Remember, “Starting is half the work.”

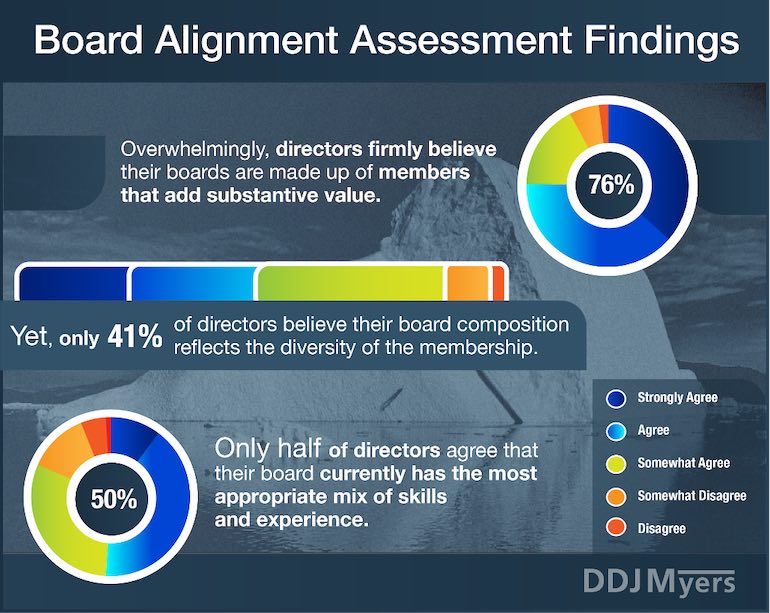

Peter Myers is SVP of CUESolutions provider and Advancing Women sponsor DDJ Myers, an ALM First company. DDJ Myers has been working with credit unions in a professional development capacity since 1989. The company has won awards for our innovative and impactful work across the country with organizations of all shapes and sizes. As part of its CEO succession planning process, executive search work, or strategy development and deployment programs, DDJ Myers deploys its board alignment assessment, an online assessment tool that enables boards to assess performance, leverage strengths, identify gaps, and measure progress as a self-governing fiduciary body.