10 minutes

These investments are good tools for managing both strategic and liquidity risk.

As stated in section 203 of the March 1990 Investment Securities Comptroller’s Handbook, an investment account should contain some securities that may be quickly converted into cash by immediate sale or by bonds maturing.

The basic objectives of a sound investment policy are the same for all financial institutions, but the emphasis placed on each will vary according to the individual institution’s needs. The basic objectives include:

- Minimizing risks

- Generating a favorable return on investments without undue compromise of the other objectives

- Providing for adequate liquidity

- Meeting pledging requirements

Whether a security is an appropriate investment depends upon a variety of factors, including the institution’s capital level, the security’s impact on the aggregate risk of the portfolio, and management’s ability to measure and manage balance sheet interest rate and liquidity risks on an institution-wide basis.

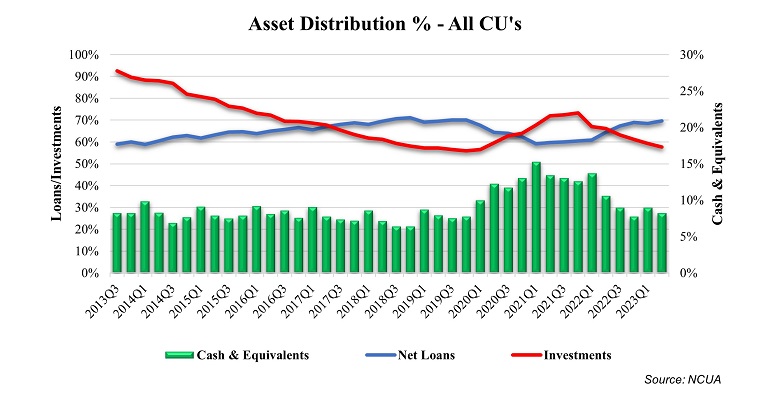

Never before seen fiscal policy measures (e.g., stimulus payments & PPP loans) led to consumers and commercial businesses holding greater cash balances. In addition, deferrals on loan payments, expanded unemployment benefits and rent & foreclosure moratoriums led to record levels of liquidity being held by financial institutions.

“The first half of 2022 experienced the sharpest increase in interest rates in decades. A sharp rise in interest rates may amplify market risk exposure to earnings and capital.” (NCUA Supervisory letter 2022-01 |Sep-22)

Despite regulatory caution against “chasing yield” and record low yields & spreads, the incremental income of MBS (vs. short-term alternatives), proved too tempting as credit unions experienced an influx of cash while loan growth continued to decline.

Per SL 2022-01, “A credit union may have invested in securities with longer maturities or increased its lending in long-term fixed-rate loans to enhance earnings by pursuing higher returns on assets.”

The NCUA expects credit unions to vigilantly monitor risks created by changes in market rates:

“Strategic Risk - If rates rise significantly, credit unions may experience a rising cost of funds and an extension in the average life of their assets, which limits opportunities to reinvest or generate additional loans at higher yields.”

Par SBA floaters can add incremental income without taking on undue duration/price risk and potentially sacrificing liquidity needed to fund future loan business.

"The credit union system has experienced significant growth in complexity over the past two years with total assets growing by approximately 25 percent. As the system has grown, concentrations in longer maturity assets have significantly increased sensitivity to changes in interest rates." (NCUA SL 22-01)

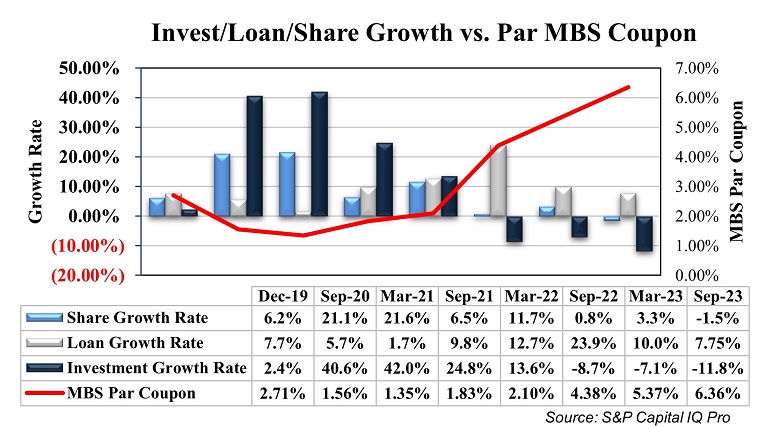

COVID-19 entered the conversation in 2020, with the first confirmed case on Jan. 20, 2020. By March 15 of that year, states began implementing shutdowns and the Trump administration signed the CARES Act into law on 3/27/20. Stimulus money, Paycheck Protection Program loans and various payment deferrals led to unprecedented share growth. Awash in liquidity and a false sense of indefinitely persistent low rates, credit unions invested cash at a 36% annualized rate (2020-21) while mortgage-backed security coupons reached all-time historical lows as illustrated in the graph above.

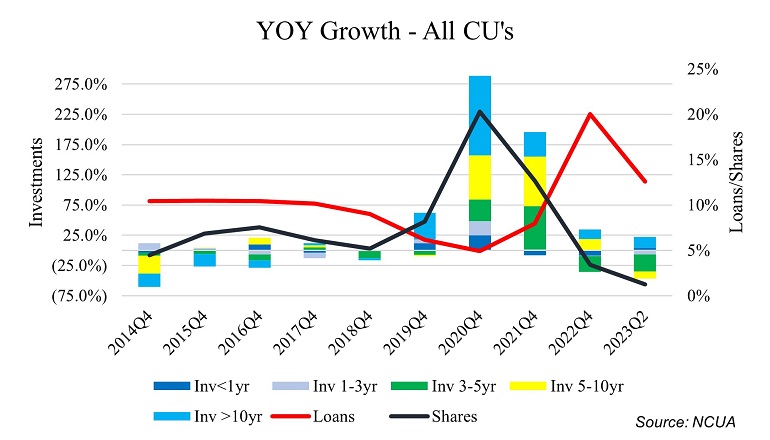

Investment growth (by maturity) can be seen below along with overall credit union loan and share growth over the last 10 years. Over the course of 2020, CUs largely invested in securities with greater than 10-year maturities. Despite the a general decline in investments (below), there continued to be growth in longer maturities as average lives extended in response to rising rates.

“Liquidity Risk - A credit union should maintain adequate liquidity to manage both expected and unexpected cash flows from changes in interest rates without adversely affecting either short-term liquidity needs or the credit union’s financial condition. Changes in interest rates can impact a credit union’s primary source of funds (generally member shares), which can lead to a strain on liquidity.” (NCUA SL 22-01)

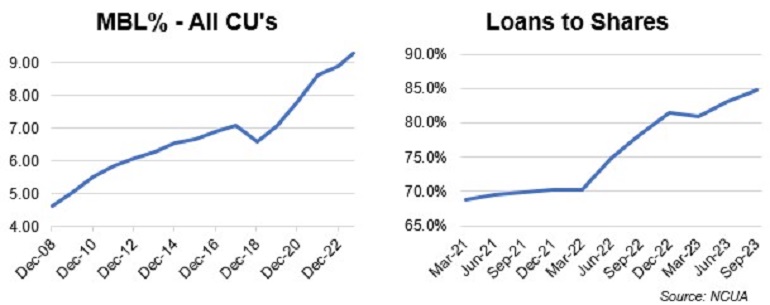

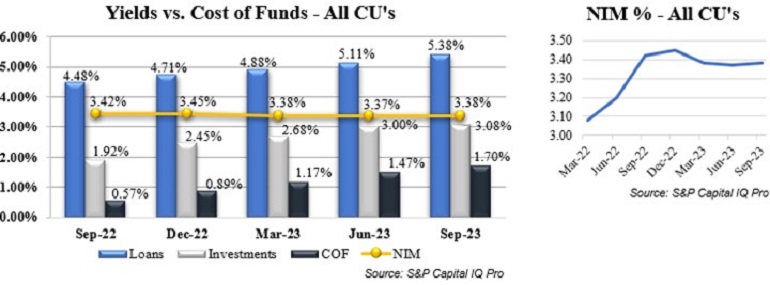

Post-COVID, CUs have experienced strong loan demand—particularly in 2022. On the other hand, rapidly rising rates have led to decreased liquidity and funding pressures; pushing the average loan-to-share ratio to 85% from 70%.

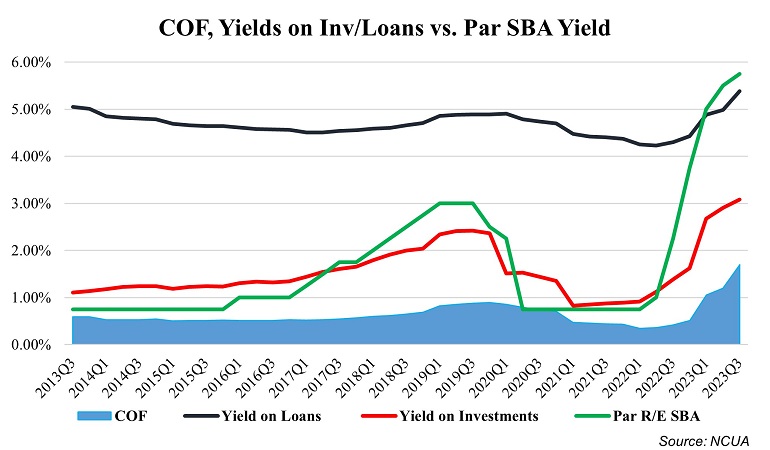

Although credit unions offer many of the same products and services as commercial banks, CU lending is largely fixed-rate and consumer-based (85% real estate and vehicles). As such, there was very little change in the average yield on loans as a result of the Dec. 15 to Dec. 18 Fed tightening cycle, as seen in the chart below.

Without appropriate consideration of the institution’s overall asset/liability management position and an assessment of its capacity to assume incremental risk, such investment practices may represent inappropriate yield chasing and an unsafe and unsound practice.

Over the past 10 years, par SBA yields (green line) have outperformed the average CU yield on investments—during both Fed tightening cycles. Moreover, SBA yields currently exceed the average yield for both investments and loans in the current cycle.

Banks largely cater to the needs of their commercial clients and tend to lend more on a floating rate basis. As of Q3 23, only 9.3% of outstanding CU loans were member business loans.

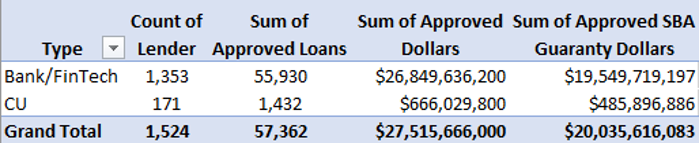

Based on the 2023 year-to-date data from the SBA above, CUs only account for about 2.5% of all SBA lending. Although there are statutory limits on the amount of member business loans that may be held by a federally insured credit union, FCUs may rely on the exception provided in §701.21 (e) and make MBLs as part of a government-insured or -guaranteed loan program. The MBL rule permits FCUs to make MBLs under government programs, as authorized under §701.21 (e), to the extent the terms and conditions under which the guarantee or insurance is provided are consistent with Part 723. 12 C.F.R. §723.4. The SBA is a government agency offering guaranteed loan programs to which the aforesaid exception applies.

Most CUs, however, do not have the expertise or cannot bear the costs of developing small-business programs. Lending to small businesses involves unique challenges that banks are particularly well suited to meet. Of particular significance, information on the financial condition, performance and prospects of small businesses may not be readily available, so, relative to other types of loans, those to small businesses are often based more heavily on information gathered through established relationships. Commercial banks continue to maintain local branch networks, which aid them in nurturing relationships and gathering firm-specific information. Additionally, increased investment in and the use of sophisticated technological and analytical tools, particularly credit-scoring techniques and expertise in credit card programs, is not as prevalent at CUs.

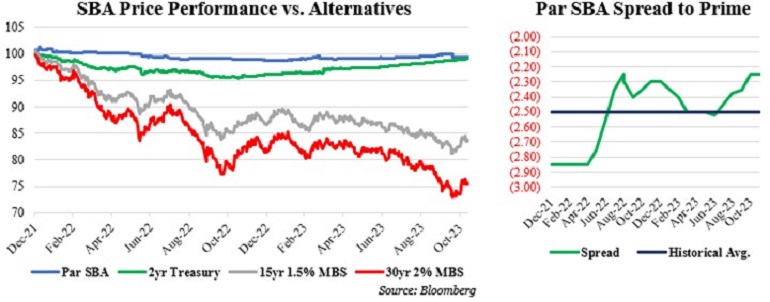

Due to their short effective duration (~.25), par SBA floater investors have been spared much of the unrealized losses currently plaguing many financial institutions.

Par SBA Floaters issued at the tights of 2021 (prime - 285) have traded between about 99-11 & 99-28, while those issued near the historical average (-255) have traded between ~100-3 & 100-15. Most recently, 25yr real estate pools have widened out to prime – 225bps.

On the other hand, 2yr Treasury notes declined nearly 4.25 points since 2021, while 15-year 1.5% and 30-year 2% MBS prices fell nearly 20 to 30 points.

Since Brean issued its first SBA pools in 2021, par SBA floater prices have declined minimally (due to tighter new issue margins—to prime), but have otherwise remained relatively stable.

And there’s good news—credit unions are allowed to purchase floating rate SBAs (in both loan and security form), thus allowing your institution to get greater exposure to commercial loans without having to invest in infrastructure and personnel.

After expanding 37 basis points to 3.45%, from 3.08% in 2022, CU net interest margins have stopped their ascent and are holding steady so far in 2023 (above).

Given rising loan-to-share ratios and the potential for funding costs to outpace asset yields (in a Fed “higher for longer” scenario), par SBA floating rate pools should be considered a core CU investment portfolio holding from both a strategic risk and liquidity risk perspective.

Furthermore, if liquidity pressures abate and loan growth continues its descent, adding par floating rate SBA loans is an excellent way to manage strategic and liquidity risks.

Why Par-Priced SBA Loans?

Given increasing regulatory focus and favorable characteristics, purchasing par-priced SBA guaranteed loans in the secondary market can be a winning, low-risk strategy for credit unions to conservatively grow loans. Historically, premium risk (the risk of losing premium paid for the loan over the par value) has deterred investors from participating in this asset class. We strip premium coupon risk to achieve a par dollar price for regulated institutions and sell the premium coupon risk to sophisticated investors with a higher risk profile. Investors that buy par-priced loans can maintain a conservative risk profile and grow loan portfolios while achieving the following benefits:

- Fully guaranteed principal and accrued interest by the full faith and credit of the U.S. government

- All cash flows are distributed by the SBA’s fiscal transfer agent. Monthly P&I for a portfolio of multiple loans are satisfied by a single monthly remittance from the FTA. A monthly report provides full accounting details for each loan.

- In the event of borrower default, the investor follows a simple procedure to submit the loan to SBA for prompt repayment of the then outstanding principal plus accrued interest.

- Most loans have variable, prime-based interest rates that adjust frequently and have no periodic or lifetime interest rate caps. This an important consideration for managing interest rate risk.

- Loans generate attractive, floating spreads to comparable short-term rates, such as the Fed funds target rate.

The guaranteed portions of SBA 7(a) originations are actively originated and sold in the secondary market, often at substantial premium dollar prices, and go through the SBA’s FTA. Once the initial sale into the secondary market is completed, SBA issues a guaranteed interest certificate, representing beneficial ownership of the guaranteed portion of a specifically identified loan. All SBA loans sold into the secondary carry a GIC and are unconditionally guaranteed as to principal and interest by the full faith and credit of the U.S. government, but timely payments are not guaranteed. Purchased SBA GICs are booked in the loan portfolio.

Why Par-Priced SBA Pools?

SBA pools are government guaranteed pass-through securities that are assembled using the guaranteed portion of SBA 7(a) guaranteed loans. Par-priced SBA pools are booked in the investment portfolio and feature the following characteristics:

- Monthly P&I payments are guaranteed on a timely basis by the full faith and credit of the U.S. government

- SBA pools are modeled on Bloomberg and are actively traded in the market. Par-priced SBAs offer superior liquidity versus premium-coupon pools.

- Portfolio sector diversification.

- Great asset for managing interest rate risk (short-end of maturity ladder with variable interest rates reset on a quarterly basis/no caps)

- Investors own a fractional and undivided interest in every loan in the SBA Pool to diversify investments over a large base of underlying loans.

The majority of SBA 7(a) loans sold into the secondary market are used to create SBA guaranteed loan pool securities. To form a pool, the pool assembler submits a number of qualifying GICs along with its pooling application. Immediately upon being issued, the SBA pool security is deposited into the Depository Trust Company system. SBA pools are fully guaranteed securities by the U.S. government and booked in the investment portfolio. In contrast to loans, monthly P&I payments are guaranteed on a timely basis by the full faith & credit of the U.S. government.

Both SBA Loans (GICs) and SBA pools are permissible investments for credit unions, according to the Federal Credit Union Act and a 2003 legal opinion from the U.S Department of Agriculture.

Andrew Pritchett serves as managing director of financial institutions group strategy for Brean Capital and is a seasoned fixed income strategist and treasury management professional with more than 25 years in the banking, broker/dealer, ALM consulting and mortgage industries. He has been on both the institutional buy‐side and sell‐side and provided portfolio analysis and balance sheet strategies to financial institutions and portfolio managers nationwide, as well as a broad variety of research related to derivatives, economics, interest rates, investments, interest rate risk management, options and wholesale funding.