2 minutes

Solid credit administration is the back-end safety net every credit union needs.

A little more than a year ago, we wrote about our “Sunny Forecast for Member Business Lending.” With anticipated double-digit growth, we encouraged credit unions to invest in the competency of their lenders and their MBL program.

Fast forward to 2017. You’ve done everything right to build a quality commercial lending portfolio and take advantage of market opportunities:

- You’ve trained your lenders.

- You’ve established policies and practices that allow you to make loans at an acceptable level of risk.

- You’re cross-selling additional member business services.

- You’re working with the business’s principals and employees on their personal needs.

And, you’re reaping the rewards in terms of multiple successful, long-term, mutually beneficial commercial relationships.

But how are you doing on the back end? No one sets out to make bad loans, but sometimes good loans take a turn for the worse. A well-conceived and executed credit administration safety net can catch early signs of trouble and give you time to respond before a good loan deteriorates into a write-off. It should be founded on a comprehensive internal risk rating system and include expertise in the areas of:

- workout strategies and file documentation

- collateral possession and conversion strategies

- collections, foreclosures and bankruptcies

- managing Other Real Estate Owned (OREO) properties

- managing charge-offs

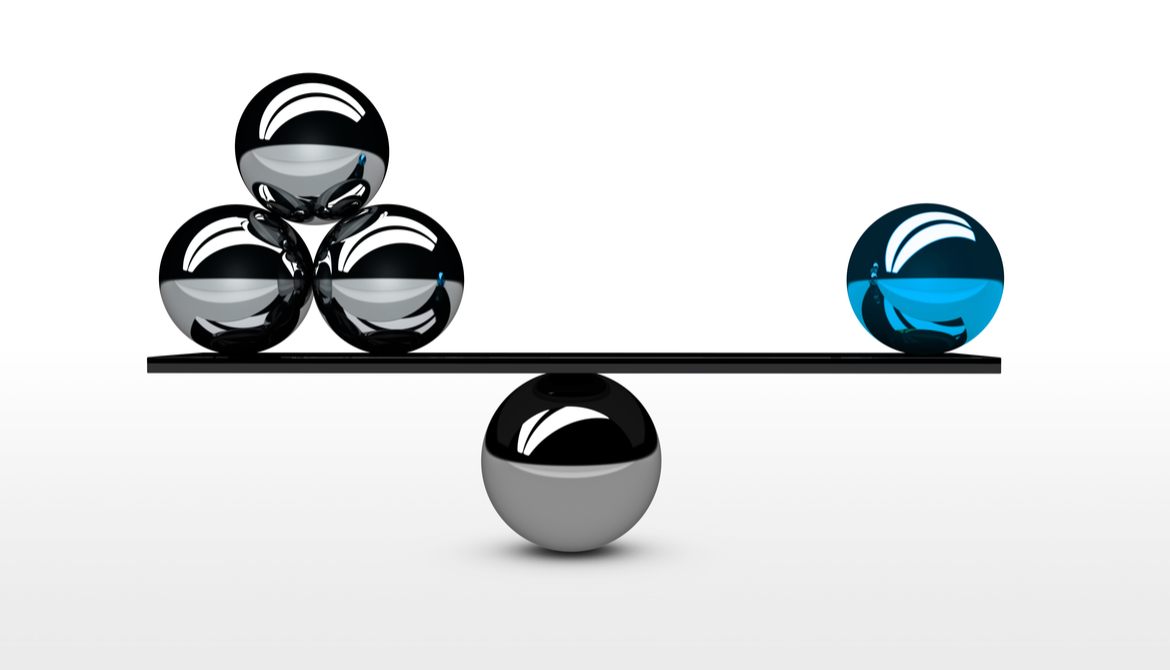

Sound credit administration provides the perfect balance to your loan origination program and allows it to thrive. Credit unions that give equal attention to their credit administration practices can also look forward to a sunny forecast for the viability and profitability of their MBL portfolio. James R. Devine is chairman and chief executive officer and

Robert J. Hogan is president and chief operating officer at Hipereon Inc. Together, they have more than 50 years of experience working with business owners and lenders, and are the lead instructors for CUES’ series of business lending schools.