2 minutes

Make the roadmap for the new institution clear and use it as an unbiased filter every day.

When a much smaller institution joins a larger one, it’s obvious whose strategy, business model, and processes will prevail, but a merger of equals can create a much murkier picture. Innumerable decisions must be made, and clear decision filters are required.

Difficulty getting buy-in on processes could be like the canary in the coal mine; it could indicate a lack of clarity at higher levels.

Culture of Confusion

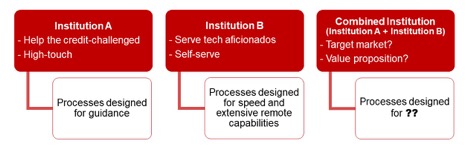

Since no two institutions are alike, bringing them together can result in an identity crisis. In the beginning, there is often a lack of clarity on the strategy and business model of the combined institution.

Some sources of confusion:

- Desired member experience is different

- Target markets are different

- Appetite for risk is different

- Geographically separated areas

It can be a tumultuous time. As decisions are made about how processes should change, the motivations behind the changes are critical. Telling one group of people to change the way they do things because the “other” side does it better will not lead to buy-in. The “why” must be clear.

Finding Clarity

Clarity starts at the strategic level. The strategic direction of the combined organization must be clearly defined, as well as the business model, including purpose, target market, and value proposition. It is rare to find institutions that are completely aligned on strategy prior to merging, so it is imperative that the strategic direction is clearly defined for the combined organization.

Strategic clarity makes it possible to define a desired member experience that is aligned with the strategy and business model, which in turn drives processes designed to create that member experience.

Creating processes that are right for the new institution should not be thought of as taking “the best of both worlds.” It’s about designing processes that are made to further the strategy of the new institution.

Less resistance will form if it is clear that the criteria for change comes from fulfilling the strategy, rather than making judgements on which processes were “better.” The constant reinforcement of aligning with the strategy takes some of the emotion out of decisions and helps people make a mindset shift to the new reality.

Mergers of equals are rarely easy. Strategic clarity won’t eliminate all the hurt feelings and turmoil, but it helps the organization move forward faster. Make the strategy for the new institution clear and use it as an unbiased filter every day. Moving forward faster helps employees settle into their new reality with less baggage so that members have a better experience.

c. myers corporation has partnered with credit unions since 1991. The company’s philosophy is based on helping clients ask the right, and often tough, questions in order to create a solid foundation that links strategy and desired financial performance. c myers has the experience of working with over 550 credit unions, including 50 percent of those over $1 billion in assets and about 25 percent over $100 million. They help credit unions think to differentiate and drive better decisions through real-time ALM decision information, CECL consulting, financial forecasting and consulting, liquidity services, strategic planning, strategic leadership development, process improvement, and project management.