3 minutes

There’s value in ascertaining the funds transfer rate across all business units.

Sponsored by Plansmith

When we discuss profitability, we often examine individual product types and their return on investment. For example, a specific loan’s profitability would be measured by adjusting its yield to include non-interest income, less applicable loan losses and cost of funds. A product profitability analysis heightens awareness of the true revenue potential of each earning asset and can help identify those underperforming within your balance sheet.

When examining branch or cost center profitability, the method is similar, but on a much larger scale. Branch budgeting and profitability include a variety of contributors, from deposit-gathering branches to lending offices, as well departments, such as investments and operations.

Develop the Business Unit/Branch Budget

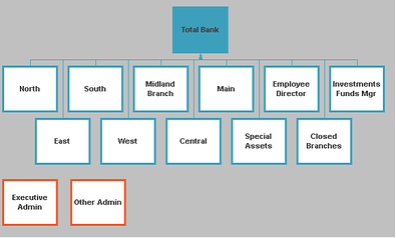

To begin, you’ll need a process or model for developing a business unit/branch budget. This scale of plan development may look something like this:

To realize the profitability of any given branch or department (aka units), we must budget at the unit level. Some units will be deposit-gatherers or funding units; others will be funds users, making loans and investments with those funds.

A business unit budget allows the institution to assign accountability and measure each unit’s current profitability and plan for its future. Profitability by unit can be measured and monitored, giving management greater control and the ability to make better-informed decisions.

Funds Pool Approach

As some units are funds-gatherers and others funds-users, at Plansmith, we automatically balance the sheet using either a “funds pool in” or a “funds pool out: approach. The use of the funds pool accounts allows the user to designate a cost of funds usage (funds pool in) or a credit for providing funds (funds pool out). The rate of exchange is determined by the institution based on other rate models within its balance sheet. Typically, this cost of funds or the funds transfer rate is ascertained and assigned across all business units.

One of the benefits of a business unit application is that the unit manager receives a departmental income statement of a fully absorbed cost basis. This means that unit’s financial statements are managed as if it were a stand-alone bank. The statements are virtually identical!

With a business unit model, the user can assign an allocation of costs from cost centers to profit centers on a percentage basis. Each profit or cost center will be able to see the direct costs attributable to its department.

Additionally, there would be other factors within a branch/departmental unit budget plan, including the allocation of overhead and capital to each unit. These are strictly for the unit itself and would be eliminated from the consolidated total bank summary.

These allocated accounts are used for balancing each branch or department and forecasting its profitability. When consolidated into the total plan level, these allocations are ignored, and balances are removed so that only the true Fed funds position is reflected.

Benefits of a Business Unit System

- Control to budget top-down or bottom-up

- Automated allocations to business units, including funds transfer pricing, cost allocation and capital allocations

- Branch and department participation, feedback and tracking

- Unit profitability performance reporting

- Holding company consolidation and reporting with automated eliminations

- Full reporting and variance capabilities at any department, region or total bank level

Deciding to expand your corporate budget into a business unit system should not be taken lightly. There are many factors to consider, such as your core processor’s ability to provide all necessary business unit identifications within your general ledger, loan and deposit applications. However, moving into a business unit system greatly encourages participation from your management team. It provides each with responsibility and accountability, while also providing them a way to be more involved in the success of the organization. Each unit manager can plan their budget, test alternatives, receive financial feedback and collaborate in a whole new way with senior management.

A former banker, Susan West is president of CUES Supplier member Plansmith. With more than 40 years of budgeting and interest rate risk management experience, she’s helped coach and cultivate both an acclaimed customer service team and thousands of powerful client users. Her goals are to demystify planning and ALM so all users can benefit from the ability to make better informed business decisions by using sophisticated yet easy-to-use software.