4 minutes

For many institutions, the answer is currently ‘yes’. But there are other options.

For most financial institutions, certificates of deposit have long been the bedrock for the investment side of the balance sheet. Given the Federal Deposit Insurance Corp. and National Credit Union Share Insurance Fund insurance coverage, ease of access and straight-forward analysis, it’s easy to understand why this would be. However, considering the outlook for the Fed funds rate and the influx of liquidity into financial institutions, we now see the CD market as un-investable for many institutions.

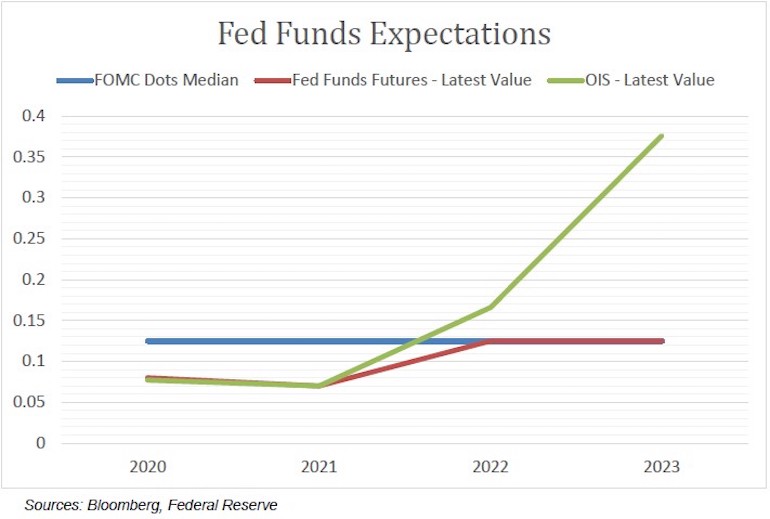

How do we find ourselves faced with an un-investable CD market? First, with the government insurance coverage provided on the first $250,000 on deposit at a financial institution, the CD market pays minimal credit spread above the risk-free rate (the rate when risk is zero). While CDs purchased through a brokerage firm are often assigned CUSIP numbers and have active secondary markets, CDs purchased directly from a financial institution are often less liquid and subject to early redemption penalties. As a result, direct placement CDs often receive some additional spread for the lack of liquidity. In either case, with the current forward guidance from the Fed that it plans to keep interest rates near zero for the next three to five years, the risk-free rate remains anchored within the current Fed funds target range of 0-0.25% for tenors (time to maturity) out to three years. Further out the yield curve, we see risk-free rates stuck below 1% at the 10-year tenor due to low inflation expectations. Current Fed funds expectations are illustrated in the graph below.

A second compounding factor that impacts the unattractiveness of the current CD market is the fact that practically all financial institutions have a surplus of deposits on their balance sheets as a result of fiscal stimulus and higher consumer savings in response to the global COVID-19 pandemic recession. According to Sept. 30 data from CUESolutions provider CUNA Mutual Group, Madison, Wisconsin, national credit union savings balances are up more than 18% year-over-year and loan-to-assets ratios are down to 65% from a peak of 72% in late 2018. Because financial institutions have ample low-cost funds available on their balance sheets to fund loan opportunities, there is little need to tap the wholesale CD market to fund the balance sheet. With fewer issuers, supply and demand economics apply, and issuers have little incentive to offer rates much higher than the Fed funds target range.

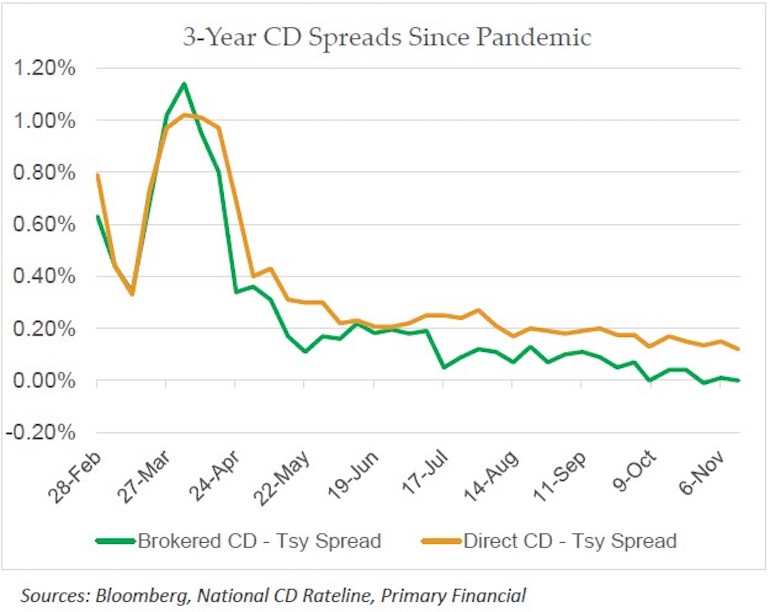

Lastly, the CD market has become un-investable on a relative value basis. There are more attractive opportunities for credit union investors in other permissible asset classes. As illustrated in the graph below, we have seen CD spreads over Treasury bonds completely evaporate since the start of the pandemic. Brokered CDs offer no yield advantage relative to Treasury bonds and direct placement CDs only pick up an estimated 15 basis points. As illustrated along the left axis of the graph below, before the pandemic, direct placement CDs could be found at spreads of around 80 basis points over Treasury bonds.

As an alternative at the three-year tenor, U.S. agency bullets—option-free bonds issued by government-sponsored enterprises—offer yields that are equal to or better than CD offerings while also providing improved liquidity and scalability. For longer-duration investments, we are regularly seeing well-structured agency collateralized mortgage obligations with base case yields between 0.70 to 1% for three to five-year weighted average lives.

To insulate downward pressure on investment income, credit union investors will need to look to the agency debenture and agency mortgage-backed security market to preserve investment income. Additionally, once a well-managed agency MBS/CMO portfolio is implemented, it produces amortizing cashflows that resemble a CD ladder, but at a higher yield. Of course, these types of securities require professional analysis and the learning curve can be steep at first.

It isn’t necessary to scrap CDs entirely from a credit union investment strategy, but given the current outlook for interest rates and ample deposits on financial institution balance sheets, these investments will not be drivers of investment income any time soon. Instead, CDs should be utilized as short-term cash alternatives matched to near-term net loan growth needs.

JD Pisula is VP/strategic advisory for Accolade Advisory, Columbus, Ohio.