6 minutes

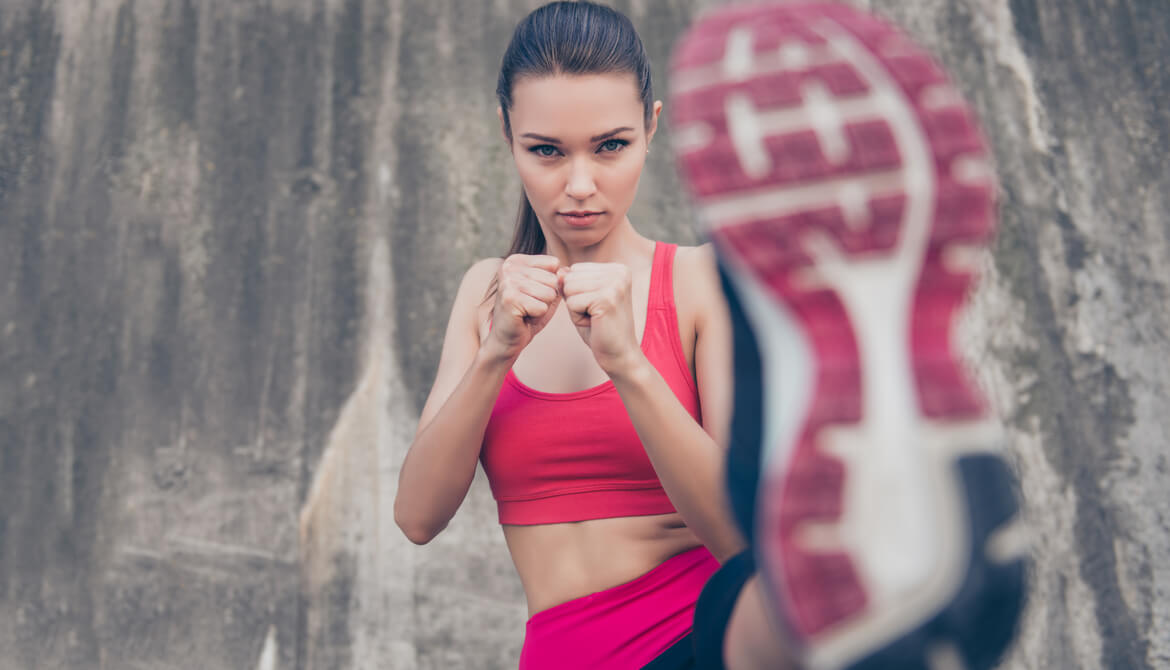

To win against many factors threatening credit union loan programs and portfolios, keep your focus and stay on the offensive.

It may be because I’ve been in this business long enough to realize that building and managing a top-quality loan portfolio is tougher than ever. It may just be that I long for the past when lending was simpler. Regardless, it’s clear to me that there is a wealth of attackers on our lending business model today, and we have to be more diligent than ever.

Digital Attacks

COVID-19 has accelerated the digital transformation of financial services. In the past 12 months, Ent Credit Union has experienced significant growth in the percentage of its consumer loan applications coming from the digital channel. Not only are we seeing more mobile and web applications, we’re also experiencing stronger application quality. While most credit unions have developed some level of digital lending capability, it’s likely we’ll always be playing catch up to the fintechs.

While the fintech lending battleground has primarily been focused on personal loans, more and more new lenders are focused on auto and home equity loans, on top of the competition for mortgages from Rocket Mortgage/Quicken Loans. There is no such thing as a “safe” portion of our portfolio!

Electric Vehicles Represent a ______ to Our Loan Portfolios?

When I was in school, I always thought multiple-choice tests were easier; fill-in-the-blank questions always seemed harder! I suppose there are two logical ways to fill in the blank above: threat or opportunity. Right now, I’m betting on “threat” for the following reasons: First, if we’re to learn from Tesla’s early years as the market’s leading electric vehicle manufacturer, the company is not only trying to revolutionize the passenger vehicle but also working to change the way cars are bought and financed. Tesla is directly selling cars, eliminating the middleman dealer. It’s dealing with national lenders for its financing options. As more new entrants come into the EV market, will they also adopt a direct sales model?

Leasing is also the dominant way EVs are being financed. Leasing is perhaps the one major drawback to being a not-for-profit financial institution. Unlike the banks, we don’t enjoy tax advantages from owning a fleet of cars that are leased out to consumers and recognize the depreciation. I see leasing continue to grow as EV sales grow. Wealthier consumers who demand the latest in features may view upgrading their cars much like we all tend to upgrade our phones to get the latest features. Long-term loans will be less likely; short-term leases will take their place.

Managing Mortgages in This Interest Rate Environment

COVID-19 also brought us the lowest fixed-rate mortgage loans in history. The challenge for credit unions was significant: Do we hold onto these low-rate loans or do we take the gain on sale profit (which has been significant) for selling these loans on the secondary market? If we hold a large portion of these low-rate loans, we might risk a negative impact from one of the COVID-19 effects: the increased prevalence of working from home. When rates rise, consumers are less likely to prepay their low-rate loans. If you’re a consumer with a 30-year fixed-rate mortgage with an interest rate in the 2’s, the only reason you might pay it off early is if you sell your home and move. Yet, if you can work from home, you can change jobs and not have to move. Will this have the effect of adding to the interest rate risk of holding mortgages? I think it will!

If we sell mortgages because we don’t want to take on the interest rate, what loans can we add to the portfolio? Auto loan growth has slowed significantly because this low-rate environment has made it cheaper for the manufacturers to offer 0% financing. Home equity loan balances are declining nationwide as consumers consolidate debt into new first mortgages. Consumers also seem very anxious to pay off credit card debt, so the opportunity for growth in card balances is suspect as well. Your credit union may not have a lot of choices other than to accept the interest rate risk and hold more mortgages.

The Bankers Are Getting Better!

After the financial crisis, the quality of service from the big banks was the source of many jokes in the credit union world. Whether it was the Wells Fargo sales fiasco or the poor job banks did with mortgage modifications, we had the opportunity to take off and build market share. In reality, the credit union share of financial assets grew from perhaps 6% to 7% in a decade.

Yet in the last year or so, consumer satisfaction with their big banks has grown, primarily driven by feature-rich mobile applications. In this environment when digital is so important, especially to potential members who make up the majority of credit-hungry consumers, will credit unions be able to keep up in attracting new members? That’s my concern: One aspect of our business model has been we bring in new members and find ways to lend to them later.

Can we pivot to an environment where we attract new members via a loan product and then find a way to get them to open and utilize a checking account with us? Both aspects of that strategy are questionable, seeing the improvement in bank satisfaction.

Non-Organic Loan Growth

It’s unique to our industry that credit unions for the most part all get along. That makes being able to manage your balance sheet by loan participations (buying and selling) a lot easier. If your credit union doesn’t have the organic loan demand or benefits from having a strong loan engine, you can buy loans from credit unions that have plenty of loans! In addition, not only can you diversify your balance sheet and buy loans that normally aren’t in demand by your members, you can also buy loans originated in other parts of the country, reducing your geographic concentration risk.

With an influx of deposits due to COVID-19, there are more buyers of loan participations than ever. On the seller side, they have that same influx of deposits, and they’re more likely to hold onto loans as well. Making this equation even more complicated, there may be credit union sellers that are headquartered in parts of the country that could be “losers” in the work-from-home revolution. There is plenty of real evidence that many high-tech and financial industry workers that live in some of the high-cost areas of the country are realizing that if they can work from home, home can be anywhere. There might be more risk in these loan pools than history might suggest.

What to Do?

There are no easy answers in terms of tactics to defend your portfolio. If I were to offer two pieces of advice, they would be to first, keep your focus. It’s easy to pursue a lot of ideas to generate bits and pieces of loan volume, and some of those ideas may not make big impacts. The second piece is this: Stay on the offensive. Now is not the time to be defensive. To use a sports analogy, this is a high-scoring game. You must outscore your opponent. Streamline your processes. Build your sales team. Improve your user interface. Create a sense of urgency with your staff to fund loans faster than ever. Have the best-balanced loan portfolio possible and don’t rely so heavily on just auto loans or mortgages.

Bill Vogeney is the chief revenue officer and self-professed lending geek for $7.6 billion Ent Credit Union, Colorado Springs.