But you can’t be a lending geek until …

As you may have noticed, the end of every article I’ve written for CUES since December 2018 includes a byline that says I consider myself a lending geek. And I do. I even wrote an article on the merits of trying to identify and cultivate lending geeks. But what does it really mean to be a lending geek and how can one help your credit union?

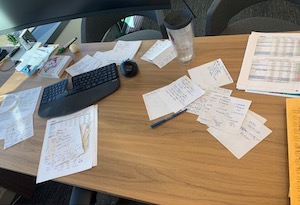

Geek Quality 1: A Disastrous Desk

I’ve had the good fortune of working with people who had a meticulously clean desk. That’s not me, and it’s probably not what you’ll see with a lending geek. Here’s a recent picture of the state of my desk.

Thanks to my daily dog calendar, I have a nice supply of scrap paper to make notes, and I make a lot of them. Also, I have a short attention span and like to joke I am a product of the TV age. Commercials come on every seven minutes and on my worst days, it seems like I need to take on something new every seven minutes as well. I’m always thinking of something I need to do. The day I took this picture I was back in the office after more than six weeks of leave for my knee replacement surgery. Physical therapy, some discomfort and a general lack of sleep caused me to not keep up with many emails during this time.

Yet I had followed one email thread about loan losses and some unusual charge-offs. An increase in our normally very low losses, combined with some larger provision for loan loss expenses (thank you CECL) inspired me to come in and take a fresh look at delinquency trends. That leads me to another potential attribute of a lending geek, besides a disastrous desk …

Geek Quality 2: An Unquenchable Thirst for Understanding

I’ve been in the lending business for almost 40 years and my methodology on this day, looking at our delinquency and losses, was absolutely unlike any analysis I’ve done. Each sheet of the dog calendar represents a different way to look at our portfolio, and I needed to sketch it out before I tried to make it look pretty in Excel.

There is an old saying, “You don’t know what you don’t know.” On a regular basis, I try to figure out what I don’t know about lending. The people who have worked most closely with me (God help them) have heard me say many times, “I’m looking for something; I’m just not sure what I’m looking for.”

Two examples, approximately 20 years apart, illustrate what I’m talking about. I’ll address the first one here and the second one in the section about geek quality No. 4.

Almost 20 years ago, I sought to address a couple of concerns with Ent’s indirect lending program. One, I wanted to see if I could better manage credit risk and volume. Could we take on more risk in some areas, avoid it in others and perhaps make more loans? The second was how we could stand out to the dealers in a crowded arena of auto lenders.

In short, I had this idea: We generated a lot of new members from indirect. What were the chances that these new members didn’t pay as well as established members? I had a fair share of data I could draw upon: several years’ worth of indirect new loan data, including date of loan, loan amount, FICO score, date of membership and, sometimes, loan loss amount. But how would I do the analysis? I hadn’t done it before, and I had to start by defining what an established member was. For this purpose, I drew the line in the sand at six months. I then separated the data by length of membership and sought to calculate loss rates. In short, while the difference in performance wasn’t a lot at the A+ credit level, I started seeing differences in performance on high 600 FICO scores. Once I got down to borrowers in the lower 600 FICO score range, there was at least 100 basis points (1% loss rate) difference in loss levels.

Someone who regularly does such analyses might just be your resident lending geek.

Geek Quality 3: A New Level of Strategic Thinking

Back to my analytical work on how established members versus new members repay their loans; what did I do with the findings? If we were going to push the envelope in lower credit score ranges, we’d do it for existing members and we’d make decisions and price loans for those folks that would be hard for our competitors to match.

Thinking about the value of lending to our existing members made me think about members in general. I think at the time we had over 200,000 members who historically were really loyal. Yet we did very little in terms of marketing our indirect program to those members. What would happen if we really promoted our program and asked them to ask for Ent (financing) at the dealership next time they are buying a car?

The result was that the dealers started hearing from a big chunk of their buyers that they were Ent members and wanted an Ent loan. As a result, it became a lot harder for dealers to send the member’s loan to another source. In addition, the campaign had the effect of raising our status with the dealers.

Hearing from Ent members made it seem like we were promoting doing business at their dealership. Seeing that Ent’s core market at the time was 50 miles south of the Denver metro area (a metro area five times the size of Colorado Springs, meaning it has a better selection of cars) and 50 miles north of Pueblo (a smaller market with perceived better pricing), hearing from Ent members went a long way toward catapulting our market share to levels we didn’t think possible; compared to where we started, our core market share is five times greater.

A true lending geek will seek to leverage their data to develop a sustainable (if there is such a thing in lending now) and solid strategy that’s hard for competitors to copy.

Geek Quality 4: Building on Successes

That initial work on lending to established members continues to drive what we do in lending at Ent today. Here’s the second example of a thirst for understanding. Over the last four years, we’ve been working to make more B, C and D credit loans. What’s our driving force? The member relationship.

The great thing about my team is they’ve embraced the same passion for lending I have. Probably five years ago, in observing our underwriters, one of my leaders realized the underwriters were spending a lot of time on the member’s account looking for data: NSF, account balances, time a member, etc. With some work and collaboration with IT, we were able to automatically pull this data over from our core system with a stoplight system: green, yellow, red. Green, the member had the relationship we were looking for. Yellow, the account history might be a toss-up. Red? We had enough data to suggest the member wasn’t handling their account very well. Instead of minutes looking at account history, the underwriters now have what they needed in seconds. We started leaning more heavily into our internal data, driving up our consumer loan approval ratio.

Along the way, we did a few more experiments using our internal data. About four years ago, we did a pre-approved personal loan campaign that didn’t include a credit bureau pre-screen; we based it solely on account history. COVID-19 came, and we made emergency loans to members without a credit report and perhaps lost more than we anticipated; in hindsight, we made too many loans to brand-new members.

We’re currently finalizing some analysis to see what else we can draw from the data on those emergency loans. Several years ago, we also implemented a smaller, short-term loan and pre-selected more than 125,000 members who would automatically qualify based on our internal data with no credit report to pre-screen the borrowers.

About a year ago, a former EntRANCE trainee figured out how to incorporate that green, yellow and red system into our automated underwriting. If a member didn’t pass our normal automated underwriting rules but got a green light, a second set of decision rules would automatically approve that member who otherwise would have to wait up to an hour for a manual decision.

You Can’t Truly Be a Lending Geek Until…

I recently saw a tidbit on leadership that went something like this: “You can’t be considered a leader until you’ve developed another leader.” To truly be a lending geek you must develop another geek to follow in your footsteps.

CUES member Bill Vogeney is the chief revenue officer and self-professed lending geek at $9.8 billion Ent Credit Union, Colorado Springs.