11 minutes

Let’s examine several factors that hurt women during their careers to better understand what we can do to improve women’s financial lives as individuals, leaders and credit unions.

It’s the season of graduations and commencements, when young women and men finish their educations and launch themselves into the working and career-building part of their financial lives.

The first Women & Worth column discussed how women’s financial lives are marked by a series of gaps—the pay gap, opportunity and advancement gap, lifetime earnings, retirement and wealth gap.

Continuing the conversation, this second quarterly Women & Worth column will focus on the opportunity and advancement gap and its contributing factors of education and career choice, the caregiver conundrum and the necessity of negotiation. As always, the goal of Women & Worth is to further the discussion of what we can do to better women’s financial lives as individuals, leaders, and credit unions.

The Opportunity & Advancement Gap: Why Women Struggle to Climb the Ladder

The opportunity and advancement gap illustrates how women advance—or, in many cases, don’t—throughout their careers. Several factors contribute to the opportunity and advancement gap, beginning with compensation and promotion.

According to the 2024 Payscale Report, women in the “all work” (comparing all working women to all working men) category earned $0.83 on the dollar compared to their male counterparts. Women in the “equal work” (comparing the women working in the same job with the same qualifications) category earned $0.99 on the dollar.

While earning less than men, women also climb the career ladder at significantly slower rates, and their ladders are considerably shorter than those of their male counterparts. The 2024 Payscale Report found that 60% of women over 45 occupy individual contributor roles compared to 45% of men in the same age group. Just 4% of women make it into an executive role at any given time in their career, compared to 8% of men. The opportunity and advancement gap shows us that women start and stay behind throughout their careers.

More Education for Lesser-Paying Careers

A friend recently shared a meme showing two women sitting on a park bench discussing their adult children. The first woman said, “My daughter lives paycheck-to-paycheck.” The second woman replied, “Maybe she should get an education.” The first woman answered, “She has one. She’s a teacher.”

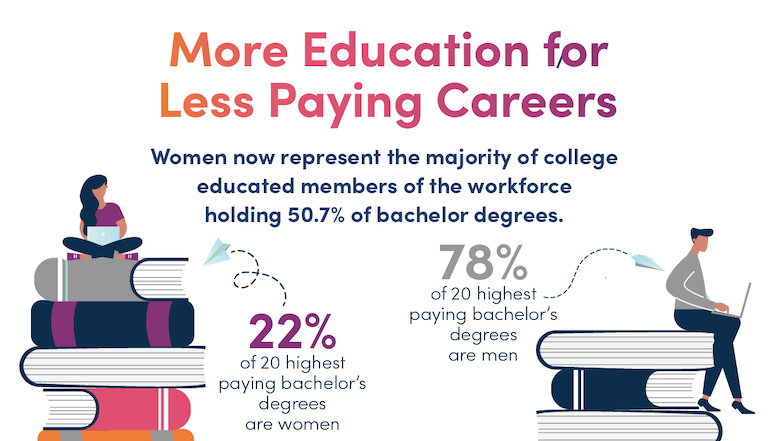

The Pew Research Center found women now represent the majority of college-educated workforce members, holding 50.7% of bachelor’s degrees. This is a milestone that has been decades in the making. Yet, despite the conventional wisdom that more education leads to more advancement into higher-paying positions, women still earn less than men throughout their careers.

This is partly explained by the degrees that women choose to pursue. Men still dominate undergraduate majors with the highest earning potential—think engineering and computer science or STEM degrees—while women continue to overrepresent in majors that typically lead to lower salaries, such as early childhood education and social work. According to a Bankrate study, nearly four in five (or 78%) of graduates with the 20 highest-paying bachelor’s degrees are men, while only one in five (22%) are women.

Making matters worse is that women take on more debt while pursuing a college education. A CNBC report found nearly two-thirds of the student debt in the U.S. is held by women. According to the American Association of University Women, among undergraduate students in bachelor’s degree programs in 2019-2020, 54% of men graduated with student loans, compared to 66% of women. Because women pursue low-paying degrees, it takes them longer to pay off that student debt, further impacting their financial lives.

WORTHwhile Considerations: Education often results in higher salaries and a lifetime of increased earnings. There is no doubt about that. However, education is not the panacea or great equalizer. The opportunity to impact change is to ensure young women understand the lifelong financial effects of education, career choice and debt. As they make decisions regarding schools and furthering their education, women need to understand options for career paths with the greatest growth opportunities, new graduate average compensation, the monthly student loan payment, and a realistic timeline of how long that amount will be deducted from their paychecks. Additionally, women need to strategically plan which university and or career paths within their field of interest will help set them up for the most opportunities and the least amount of debt post-graduation.

The Caregiving Conundrum

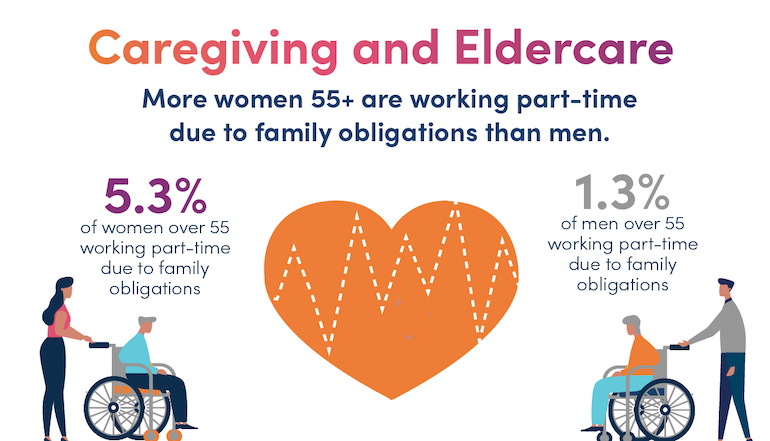

Women tend to be the caregivers in their relationships and their families. The National Women’s Law Center reports that of the one in five Americans who are currently providing care to others, 58% of them are women. Despite their increasing levels of education and regardless of their position on the career ladder, women typically take time out of the workforce or reduce the hours worked to take on caregiver responsibilities. The economic cost of caregiving is simply devastating to women’s financial lives.

This impact on women’s earning and advancement opportunities is seen most acutely when women become parents. Oftentimes called the motherhood penalty, this phenomenon is proven by the fact that the “all work” pay gap shrinks amongst women without children. A 2024 Payscale Report found that in 2023 the “all work” pay gap for women who were parents or primary caregivers was $0.75 on the dollar earned by their male counterparts compared to women who did not have children and earned $0.88 on the dollar.

Overall, the number of unpaid primary caregivers, the majority of whom are women, continues to grow. According to a Wells Fargo Report, in 2023, 1.9 million women ages 55-plus were not in the labor force due to family eldercare obligations, seven times the number of men of the same age group. It’s clear that motherhood and caregiving are powerful variables in career and pay progression for women.

Perhaps more surprising than the motherhood penalty is that when men become parents, it positively affects their careers. A National Bureau of Economic Research study found that for men, there’s a bump up or wage “bonus” after becoming a father. Fathers make roughly 20% more than men with no children. The motherhood penalty, coupled with the fatherhood bonus, makes it even harder for women to simply climb the ladder, much less get ahead.

WORTHwhile Considerations: A National Bureau of Economic Research study and CNBC report suggests that the reason why men get a “bonus” is the perception that they are the breadwinners of their family, and as such, more money is needed so they can take care of their families. The presumption is based on a societal bias, which will take time to change. The first step in the process is to acknowledge that the bias exists and take steps as leaders and as organizations to ensure that motherhood, fatherhood and caregiving are valued and treated equally.

The Necessity of Negotiation

Years ago, I attended a leadership seminar, and the speaker asked, “Where are the women? Why aren’t they well-represented at the top? Why don’t we have a pipeline of women leaders?”

The answer, simply put, was that women were stuck—stuck on a broken ladder, unable to climb faster or higher.

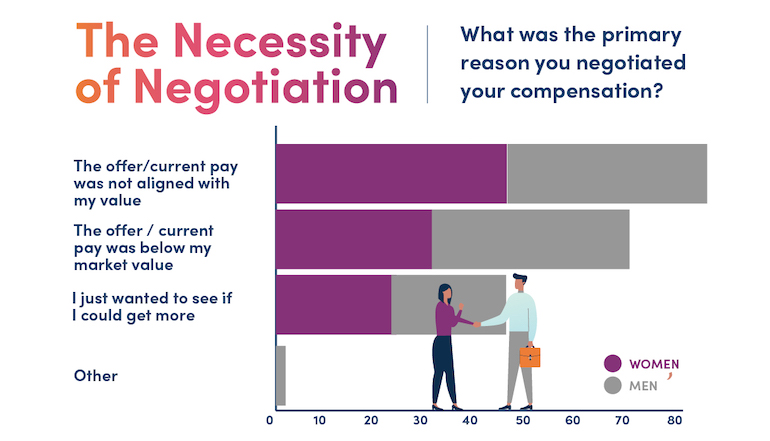

Part of getting “unstuck” is the willingness to negotiate and to do it effectively. Many women don’t like to negotiate and will shy away from negotiating more often than men. And when women do negotiate, they have significantly less productive results than men. According to resumebuilder.com, 49% of men vs. 32% of women negotiated compensation within the last two years. Moreover, when women did negotiate, only 42%, compared to 55% of men said that they achieved exactly what they wanted. The study further found that the top two reasons women considered negotiating but ultimately chose not to were the fear of losing their job or job offer (34%) and, secondly, being too intimidated (33%).

Remedying this reluctance to negotiate will be key to women's advancement. The good news is that younger women, those ages 25-34, are more willing to negotiate than any other cohort in the workforce. Starting earlier and doing it more often means women may have the opportunity to climb faster and farther.

WORTHwhile Considerations: Successful negotiating comes down to confidence, preparedness and knowing your worth. Unlike most of the factors influencing the opportunity and advancement gap, this one is very much within each woman’s power to influence and better their own financial life. Affecting change happens by normalizing the conversations around compensation and promotion, being transparent about career and opportunity pathing, and helping women to negotiate and advocate for themselves.

Let’s Continue the Conversation: Share the Worth

Examining the opportunity and advancement gap in-depth can be daunting. Still, it’s essential to raise awareness of the issues so that we can work toward solutions as individuals, leaders and credit unions.

We need your anecdotes and ideas. Please tell us which factors of the opportunity and advancement gap—education and career choice, the caregiving conundrum, the necessity of negotiation—sparked your curiosity. Which do you want to discuss more? Which ones can you relate to or have an example of a win or lesson learned that you could share?

Let’s rise to the challenge of continuing the conversation and working toward bettering women’s financial lives today and for future generations.

About Women & Worth: Our goal with the Women & Worth column is to have discussions that lead to developing strategies and solutions to help better women’s financial lives. We believe as an industry that helps strengthen people’s financial lives, credit unions are uniquely positioned to lead this initiative and bring about impactful change.

Join the conversation on social media or email us.

Bryn C. Conway, MBA, CUDE, CDPM, AMA PCM, principal of BC Consulting LLC, is a long-time member of the credit union community and helps credit unions define their brands, develop their experiences, and grow market share.

Women & Worth Resources

Women have overtaken men and now account for more than half (50.7%) of the college-educated labor force in the United States, according to a Pew Research Center analysis of government data.

Payscale's Gender Pay Gap Report includes analysis by race, job level, age, education, industry, occupation and location (metro area), as well as reasons for the gender pay gap and examples of where the gender pay gap is widest, even when all pay factors are controlled.

Women represent most of the country’s college-educated workforce, a milestone that has been decades in the making. And yet, their earnings still trail those of men. Eighty percent of the 20 most lucrative college degrees are held by men.

Women hold a majority of the student loan debt in the U.S. and face multiple financial pressures, according to a CNBC special report.

Women tend to borrow more for their education—and struggle more to pay it off—in part because of the gender pay gap.

Women face greater retirement insecurity than men—and the pandemic made it worse, according to the National Women's Law Center.

According to Pew Research, in a growing share of U.S. households, husband and wives earn about the same. But men spend more time on paid work and leisure and women on caregiving and housework.

Perhaps not surprisingly, women shoulder a disproportionate share of unpaid care responsibilities but also play an outsized role in providing paid care. As the population rapidly ages, it won't be able to do so gracefully without her.

As the children grow up and as women work more hours, the motherhood penalty is greatly reduced, especially for the less-educated group. But fathers manage to expand their relative gains, particularly among college graduates. The parental gender gap in earnings remains substantial for both education groups.

Why does motherhood cost women while fathers get a bonus?

In September, ResumeBuilder.com surveyed 1,417 full-time workers to understand, specifically over the past two years, which workers negotiated compensation, how successful they were, and what may have limited them.