4 minutes

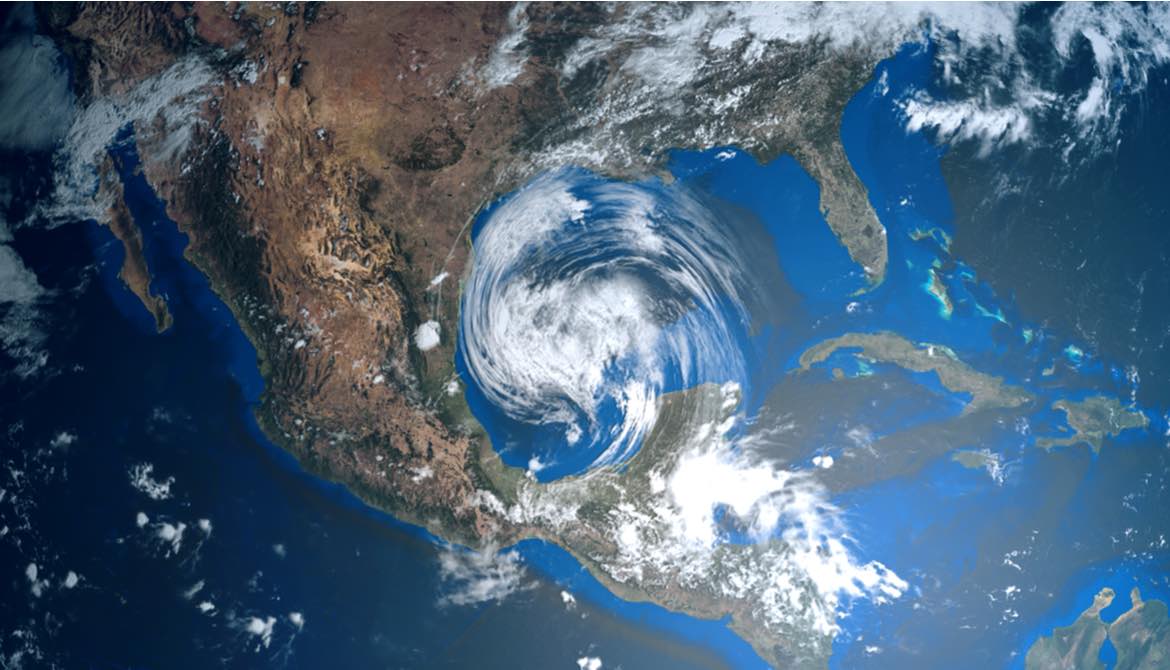

Hurricane season reminds us of the opportunity to create or review our organizational business continuity strategy.

Sponsored by SWBC

Most organizations, credit unions included, have a disaster recovery and business continuity plan in place. A business continuity plan is critical to a comprehensive risk management program. It ensures that your employees are prepared should a natural or man-made disaster strike.

As we progress further into hurricane season, it’s important that your credit union performs an audit of its current plan to ensure you’re prepared to serve your employees and members should inclement weather impact your business operations.

Back in 2018, in the aftermath of Hurricane Michael, credit unions across the Alabama and the Florida Panhandle struggled to reopen their doors due to massive power outages. Frustrated members turned to social media to express their dissatisfaction with not having access to their cash or accounts. While credit unions cannot avoid disasters, implementing, testing, and revising a thorough disaster recovery plan can greatly reduce the negative impact weather catastrophes can have on your employees and members.

While you may already have a disaster recovery plan in place, there’s always opportunity to reevaluate and ensure its thoroughness to avoid some of these critical mistakes:

Not Including a Comprehensive List of Disasters in Your Recovery Plan

The types of disasters that organizations could be subject to are vast—anything from floods, tornados, hurricanes and even such man-made disasters as arson and active-shooter situations.

According to the FBI, the number of active shooter incidents has consistently risen year-over-year in the U.S., with 250 incidents between 2000 and 2017. Given that these unfortunate incidents will likely continue to occur, it’s important that your credit union plan for such emergencies in its disaster recovery plan.

Not Creating a Diverse Disaster Recovery Team

It’s important that you create a team to develop, test and deploy your disaster recovery plan. When establishing your first-responder teams, keep in mind that including employees from different areas of your credit union will help bring to light potential vulnerabilities that may not be top-of-mind considerations.

Also, members of your disaster preparedness team do not necessarily all have to be a part of your senior management team. In fact, it’s beneficial to include junior members of your staff because, in the event of a disaster, your senior staff will be pulled in a number of ways to resolve more pressing issues.

Your selected team should thoroughly understand all aspects of the plan and its significance; they should have the tools and resources necessary to take action.

Not Evaluating Your Data Storage

It’s becoming more commonplace for organizations to move away from brick-and-mortar facilities and servers in favor of storing data in the cloud. Aside from the day-to-day physical operations, as you know, data is critical to your organization’s ability to operate, and a storm or disaster that could destroy a physical location where your data is stored could render your credit union inoperable.

According to Sherweb, a data loss event can be catastrophic, causing 93% of businesses to file for bankruptcy in its wake. While it may be impossible to completely avoid any kind of data loss event—after all, machines and technology do fail—your credit union can help reduce the impact by having a regular data back-up schedule.

Not Having Partners to Support Key Functions

Most credit unions don’t manage all aspects of their operations in-house, so it’s no surprise that when a disaster occurs, you’ll want to have a strong network of partners to assist with key functions in the event that you’re unable to operate for a period of time. While your initial focus immediately following a disaster will be getting day-to-day functions up and running, it’s inevitable that some of your risk-management functions will fall by the wayside, but you can’t lose sight of them.

Moreover, it’s been shown that delinquency will increase as consumers deal with the physical and financial disruption following a natural disaster. In 2018, mortgage delinquency rates tripled in Houston, Texas, and quadrupled in San Juan, Puerto Rico, after Hurricanes Harvey and Maria, according to DSNews. Having a collections partner that can serve as your “back-up” and make calls to delinquent borrowers while you and your team focus on other aspects of your operations aspects could be incredibly beneficial to your credit union’s disaster recovery plan.

Your credit union’s disaster recovery plan should certainly not be a “set it and forget it” document that goes un-reviewed or un-tested. With so much at stake—from your member relations to security—you can’t afford to make these mistakes in your disaster recovery and business-continuity planning.

Connie Shoemaker is VP/operations for the financial institution group’s AutoPilot® services at CUES Supplier member SWBC, San Antonio, Texas. Have you evaluated your credit union’s collections operation lately? Take our self-assessment, A Guide to Auditing Your In-House Collections.